Eligibility Requirements for Financial Aid

Securing financial aid for a coding bootcamp often hinges on a variety of factors, making the process somewhat complex. Understanding these eligibility criteria is crucial for prospective students hoping to offset the cost of tuition and related expenses. This section will Artikel the key elements that influence your chances of receiving financial aid.

Eligibility for financial aid for coding bootcamps is multifaceted and depends on several key factors. These factors often interact, meaning that a strong performance in one area might compensate for a weakness in another.

Factors Determining Financial Aid Eligibility

Several factors significantly impact your eligibility for various types of financial aid. These factors are carefully considered by lenders and scholarship providers. Understanding these will help you prepare a strong application.

- Income: Your income (and that of your family, if applicable) is a major determinant of eligibility for need-based financial aid, such as grants and subsidized loans. Lower income generally translates to greater eligibility for aid. Many programs use the Free Application for Federal Student Aid (FAFSA) or similar income verification processes.

- Credit History: For loans, a strong credit history is often a prerequisite. A good credit score indicates a lower risk to the lender, increasing your chances of approval and potentially securing a lower interest rate. Those with limited or poor credit history may find it more challenging to secure loans, or may be offered loans with less favorable terms.

- Academic Background: While not always a direct requirement, your academic background can influence eligibility for merit-based scholarships. A strong academic record, demonstrated through high grades or prior degrees, may make you a more competitive applicant for scholarships based on merit.

- Program Specifics: The coding bootcamp itself plays a role. Some bootcamps have partnerships with specific lenders or offer their own internal financing options, potentially impacting eligibility criteria. The program’s reputation and accreditation also influence the availability of external financial aid opportunities.

The Role of Accreditation and Program Reputation

Accreditation and the reputation of the coding bootcamp significantly impact financial aid opportunities. Accredited programs are generally viewed more favorably by lenders and scholarship providers, increasing the likelihood of securing funding. A reputable bootcamp with a strong track record of graduate success tends to attract more financial aid options and partnerships, benefiting students. Conversely, unaccredited or lesser-known bootcamps may have fewer financial aid opportunities available.

Comparing Eligibility Requirements for Different Financial Aid Types

Scholarships and loans represent two distinct avenues for financing a coding bootcamp. Their eligibility requirements differ substantially. Scholarships are typically merit-based or need-based, often requiring a competitive application process showcasing academic achievement, professional experience, or financial need. Loans, on the other hand, primarily assess creditworthiness and income to determine eligibility. Loan approval depends heavily on the applicant’s credit history and ability to repay the debt. While scholarships don’t need to be repaid, loans incur interest and must be repaid according to the loan terms.

Cost of Coding Bootcamps and Financial Aid Coverage: Does Financial Aid Cover Coding Bootcamp

Understanding the financial aspects of attending a coding bootcamp is crucial for prospective students. This section will examine the typical costs associated with bootcamps, the potential for financial aid, and how these factors interact to determine the overall financial burden. We will explore examples of bootcamp tuition, average financial aid awards, and create a sample budget to illustrate the financial realities.

Does financial aid cover coding bootcamp – Coding bootcamps offer intensive, short-term training in software development and related fields. However, the cost of this accelerated learning can be significant. The amount of financial aid available varies greatly depending on the institution, the student’s financial situation, and the type of aid offered (e.g., scholarships, loans, grants). Therefore, it’s essential to carefully research both tuition costs and available financial aid options before enrolling.

Coding Bootcamp Tuition and Financial Aid Comparison

The following table presents hypothetical examples to illustrate the range of tuition costs and average financial aid awarded. Actual figures will vary depending on the specific bootcamp, location, and individual student circumstances. Remember to check directly with the bootcamp and relevant financial aid providers for the most up-to-date information.

| Bootcamp Name | Tuition Cost | Average Financial Aid Awarded | Percentage Covered |

|---|---|---|---|

| Codecademy Pro | $12,000 | $6,000 | 50% |

| App Academy | $17,000 | $8,500 | 50% |

| General Assembly | $15,000 | $4,500 | 30% |

| Flatiron School | $18,000 | $9,000 | 50% |

Hypothetical Bootcamp Budget

This budget illustrates the potential expenses and income a student might encounter while attending a coding bootcamp. It’s a simplified example and actual costs will vary based on individual circumstances and location.

- Tuition: $15,000

- Living Expenses (Rent, Utilities, Groceries): $10,000 (This could be significantly higher or lower depending on location)

- Books and Supplies: $500

- Transportation: $1,000

- Personal Expenses: $2,000

- Total Expenses: $28,500

- Financial Aid Received (Loans and Grants): $10,000

- Personal Savings/Other Funding Needed: $18,500

Impact of Cost of Living on Bootcamp Affordability

The cost of living significantly impacts the overall financial burden of attending a coding bootcamp. A bootcamp in a high-cost city like San Francisco or New York City will require a substantially larger budget for living expenses compared to a bootcamp in a more affordable location like Austin, Texas or Denver, Colorado. The availability of financial aid may not always fully compensate for these differences in cost of living, potentially leaving students in expensive areas with a larger personal financial burden to manage.

For instance, the hypothetical budget above assumes $10,000 for living expenses. In a high-cost city, this figure could easily double or even triple, drastically increasing the total cost and the amount of personal funding required. Conversely, in a lower-cost area, this figure could be significantly lower, making the bootcamp more financially accessible.

Alternative Funding Sources for Coding Bootcamps

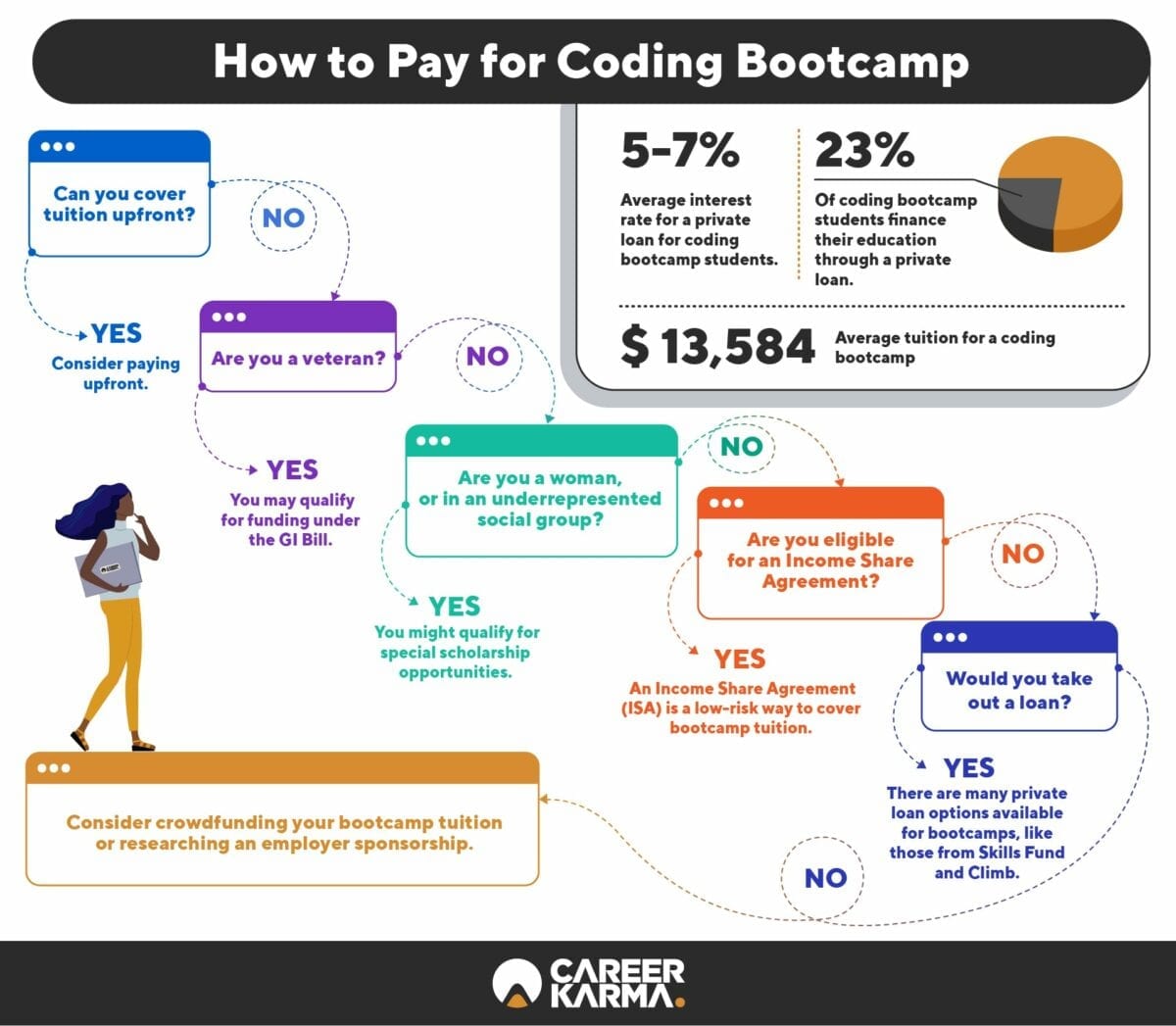

Securing funding for a coding bootcamp can be a significant hurdle. While traditional financial aid options exist, several alternative avenues can help aspiring developers finance their education. Understanding these options and their potential impact on your finances is crucial for making an informed decision. This section explores various alternative funding sources and provides a framework for evaluating their potential return on investment.

Several alternative funding sources can supplement or replace traditional financial aid for coding bootcamp tuition. These options offer diverse approaches to financing your education, each with its own set of advantages and disadvantages.

Alternative Funding Options

The following list Artikels some common alternative funding sources for coding bootcamps:

- Income Share Agreements (ISAs): ISAs are contracts where a lender provides funding in exchange for a percentage of your income for a set period after graduation. This eliminates upfront tuition costs but requires a commitment to repayment based on your post-bootcamp earnings. The percentage and repayment duration vary widely depending on the lender and the bootcamp.

- Personal Savings: Utilizing personal savings is a straightforward method. It avoids debt accumulation but requires significant prior financial planning and discipline. The amount of savings needed will directly depend on the bootcamp’s cost and any additional living expenses.

- Crowdfunding: Platforms like GoFundMe or Kickstarter allow individuals to solicit donations from friends, family, and the broader online community. This approach relies heavily on your network and the ability to effectively communicate your goals and need for funding. Success is not guaranteed.

- Family Contributions: Seeking financial assistance from family members is a common option. This avoids debt but necessitates careful discussion and agreement on repayment terms, if any. It’s important to have a clear understanding of expectations and responsibilities.

Calculating Return on Investment (ROI), Does financial aid cover coding bootcamp

Calculating the ROI of a coding bootcamp requires careful consideration of several factors. A positive ROI indicates that the increased earning potential after the bootcamp surpasses the total cost of the program. This calculation helps in justifying the investment in your education.

A simplified ROI calculation can be represented as follows:

ROI = [(Post-Bootcamp Annual Salary – Pre-Bootcamp Annual Salary) * Number of Years Worked] – Total Cost of Bootcamp

For example: Assume a bootcamp costs $15,000. Before the bootcamp, your annual salary was $40,000. After the bootcamp, your annual salary increases to $80,000. If you work for 5 years at the higher salary, the ROI would be: [($80,000 – $40,000) * 5] – $15,000 = $185,000. This is a simplified calculation and doesn’t account for taxes, inflation, or other potential expenses.

Advantages and Disadvantages of Alternative Funding Sources

Each funding source presents distinct advantages and disadvantages:

| Funding Source | Advantages | Disadvantages |

|---|---|---|

| Income Share Agreements (ISAs) | No upfront cost, repayment tied to income | Percentage of income paid can be significant, length of repayment period |

| Personal Savings | No debt, avoids interest payments | Requires substantial savings, may delay bootcamp enrollment |

| Crowdfunding | Potential for community support | Reliance on others, uncertain outcome, time-consuming |

| Family Contributions | Avoids debt, strong support network | Potential for strained relationships if repayment isn’t managed well |

Tim Redaksi