High Cost vs. Return on Investment: Why Coding Bootcamps Don’t Work

The allure of a quick path to a lucrative tech career often overshadows the financial realities of coding bootcamps. While promising rapid skill acquisition and employment, the high cost of these programs, coupled with the unpredictable nature of the job market, can lead to significant debt and a lower-than-expected return on investment. This section examines the financial implications of attending a coding bootcamp, considering both upfront and hidden costs against potential earnings.

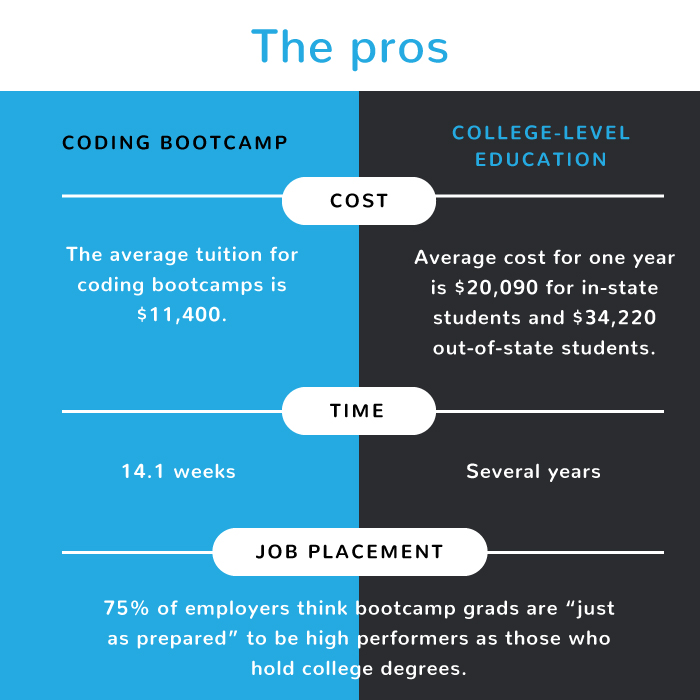

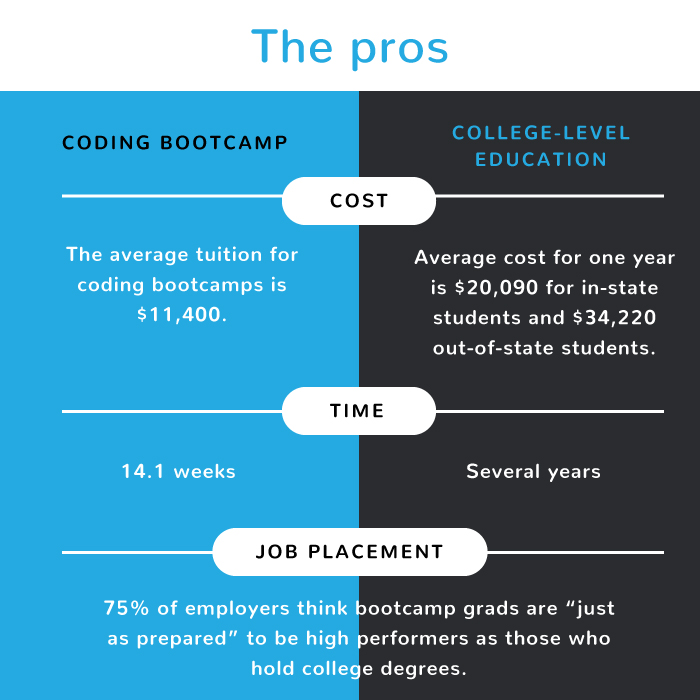

Why coding bootcamps don’t work – A crucial aspect to consider is the stark contrast between the substantial investment required for a bootcamp and the actual starting salary graduates can expect. Many bootcamps cost upwards of $10,000, and some even exceed $20,000. This significant expense must be weighed against the average starting salary for entry-level developers, which varies considerably depending on location, specialization, and individual skills. The following table illustrates a hypothetical comparison, emphasizing the potential for substantial debt accumulation and the lengthy payback period.

Bootcamp Cost and Salary Comparison, Why coding bootcamps don’t work

The data presented below is a hypothetical example to illustrate the potential financial implications. Actual figures vary widely based on location, bootcamp reputation, and individual job market success. It is crucial to conduct thorough research specific to your chosen bootcamp and target job market.

| Bootcamp Cost | Average Graduate Salary (Annual) | Net Income After 1 Year | Net Income After 2 Years |

|---|---|---|---|

| $15,000 | $60,000 | $45,000 | $90,000 |

Hidden Costs Associated with Bootcamps

The advertised cost of a bootcamp often represents only a fraction of the total financial burden. Several hidden costs can significantly impact the overall investment. These overlooked expenses can easily derail even the most meticulously planned budget.

For instance, living expenses during the intensive program must be factored in. Relocation to a major city with higher living costs is common for many bootcamp attendees, adding to the financial strain. Furthermore, many students forgo income during the bootcamp duration, representing a substantial opportunity cost. This lost income, combined with tuition fees and living expenses, can lead to a considerable debt load.

Hypothetical Scenario: Debt Accumulation and Payback Period

Let’s consider a hypothetical scenario: John enrolls in a $15,000 bootcamp, foregoing his $4,000/month job for three months. His living expenses during the bootcamp are $2,000 per month. His total investment includes the tuition fee ($15,000) plus three months of lost income ($12,000) and living expenses ($6,000), totaling $33,000. If he secures a job paying $60,000 annually, it will take him over a year to simply cover his initial investment, excluding interest on potential loans. The time required to fully recoup his investment, considering the opportunity cost, would be considerably longer.

The total cost of a bootcamp often extends far beyond the advertised tuition fees. Careful consideration of all associated expenses is critical before enrollment.

Tim Redaksi