Income Share Agreements (ISAs)

Income Share Agreements (ISAs) are an alternative financing option for coding bootcamps, offering a different approach compared to traditional student loans. Instead of borrowing a lump sum and paying it back with interest, ISAs structure repayment as a percentage of your income after you secure a job above a certain threshold. This means your payments are directly tied to your post-bootcamp earnings.

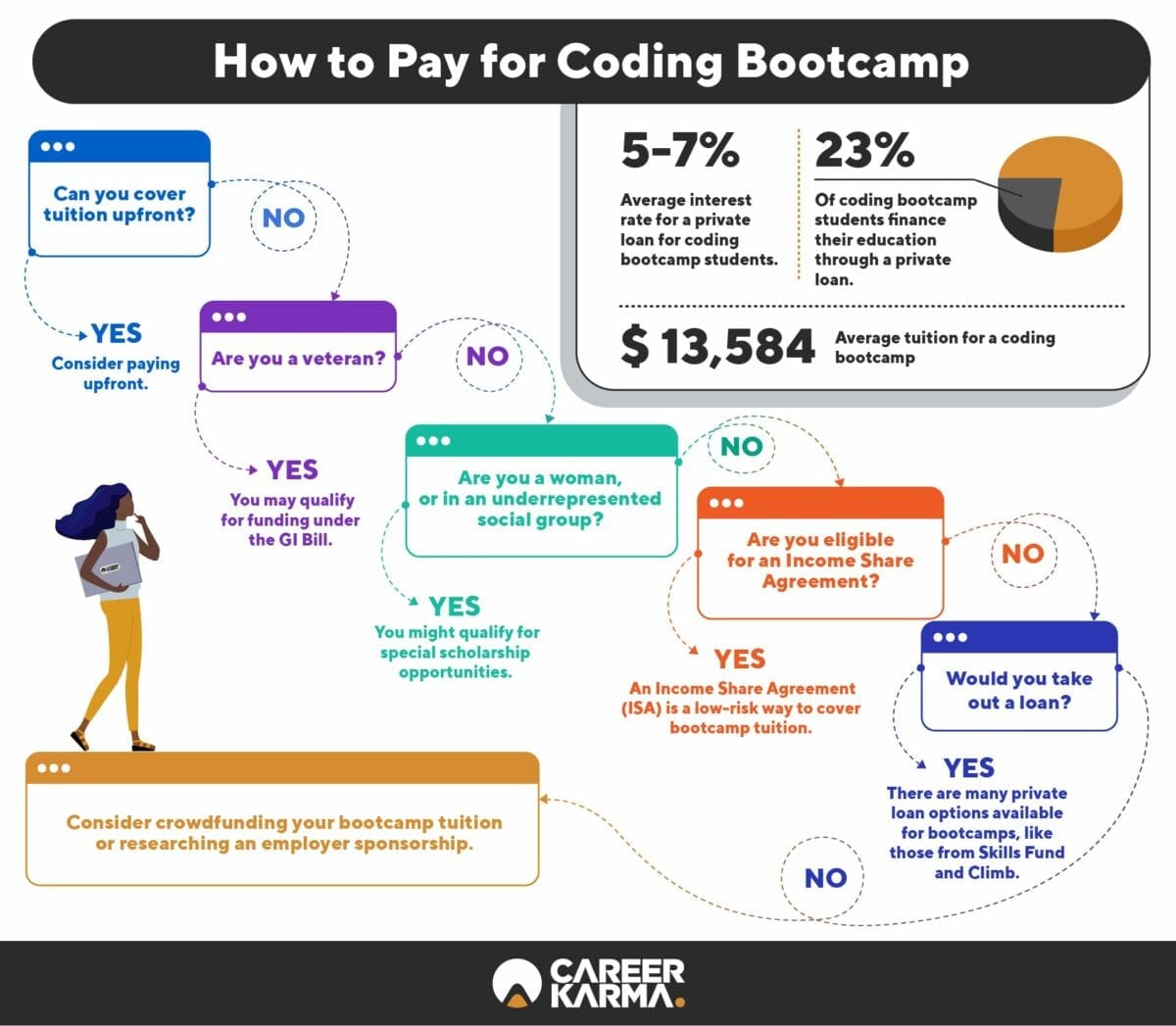

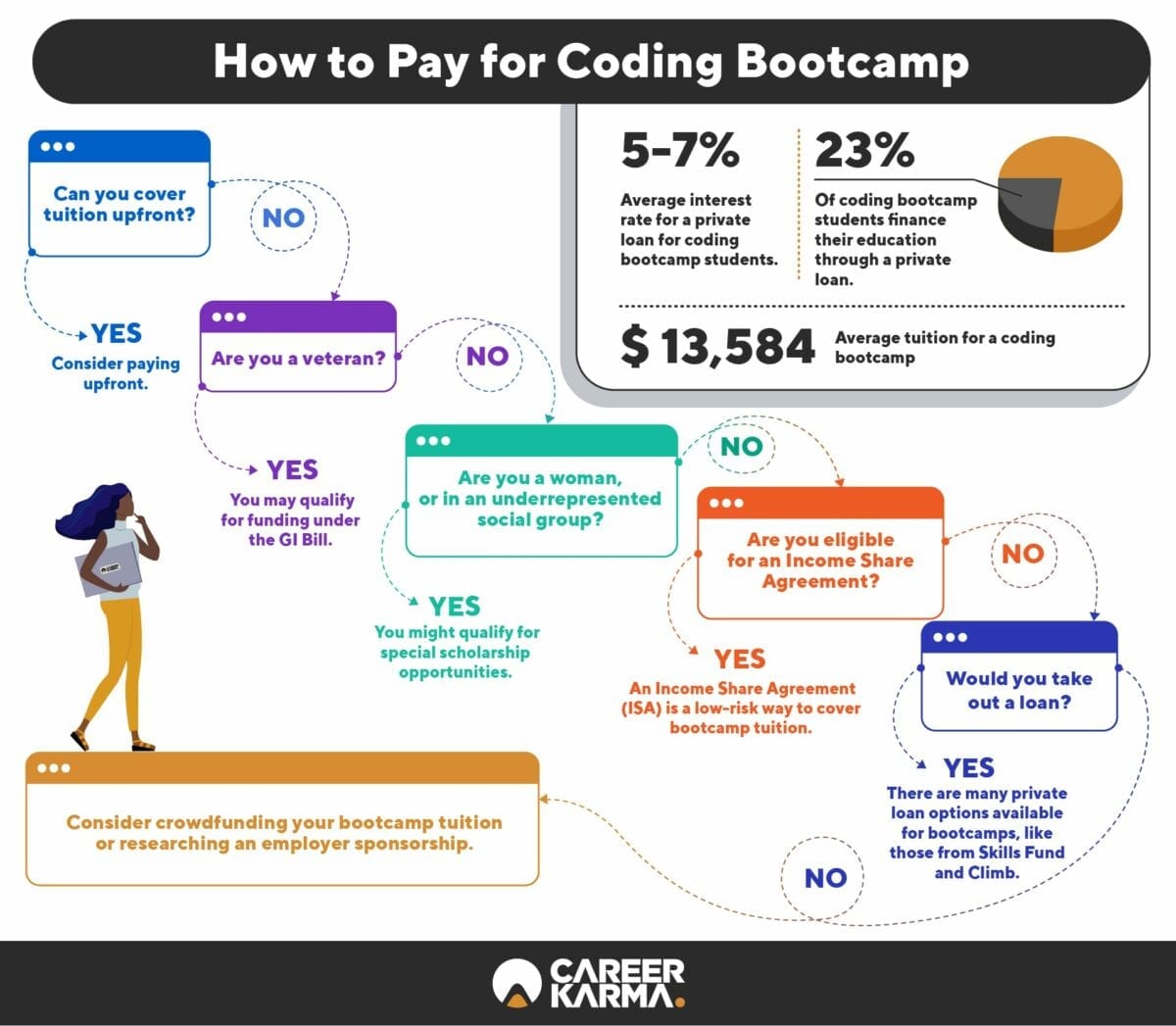

How to pay for a coding bootcamp – ISAs work by having you agree to pay a predetermined percentage of your income for a set period after you graduate and find employment exceeding a specified salary. The percentage and duration are typically negotiated upfront and Artikeld in the agreement. The total amount you repay could be capped, preventing excessively high payments, even if your income surpasses expectations. Importantly, if you remain unemployed or earn below the agreed-upon threshold, you may not be required to make any payments. This model directly aligns the bootcamp’s success with your success, incentivizing them to provide high-quality education and job placement assistance.

Comparison of ISAs and Traditional Student Loans

Understanding the key differences between ISAs and traditional student loans is crucial for making an informed financing decision. The table below highlights these distinctions.

| Feature | Income Share Agreement (ISA) | Traditional Student Loan |

|---|---|---|

| Payment Structure | Percentage of post-graduation income for a fixed period | Fixed monthly payments with interest, regardless of income |

| Interest | No interest charges | Interest accrues throughout the loan term, increasing the total amount owed |

| Repayment Trigger | Income exceeding a specified threshold | Immediately after graduation, regardless of employment status |

| Risk | Higher risk for bootcamps if students are unsuccessful in finding employment | Higher risk for students who may struggle with repayment even with low income |

Risks and Benefits of ISAs

Like any financing option, ISAs present both risks and benefits. Careful consideration of these factors is essential.

Benefits: ISAs can be attractive to students concerned about the burden of student loan debt. The income-based repayment structure reduces the immediate financial pressure, and the lack of interest can significantly lower the total amount repaid compared to a traditional loan. The alignment of incentives between the bootcamp and the student also promotes a more supportive learning environment.

Risks: The biggest risk is the potential for lengthy repayment periods if your income remains relatively low for an extended duration, or if you do not reach the salary threshold. Furthermore, the percentage of income paid back can be substantial, potentially impacting your ability to save or invest during the repayment period. Also, ISAs often require a good credit history and a high chance of successful job placement after graduation to be approved.

Examples of Bootcamps Offering ISAs

Several coding bootcamps now offer ISA financing options. The specific terms and conditions vary between providers, so it’s essential to carefully review the details of each ISA before committing. While specific bootcamps offering ISAs can change, researching reputable bootcamps and checking their financing options on their websites is crucial for finding up-to-date information. Always compare terms from multiple providers before making a decision.

Post-Bootcamp Financing: How To Pay For A Coding Bootcamp

Successfully completing a coding bootcamp is a significant achievement, but the journey doesn’t end there. Managing the financial obligations incurred during your training is crucial for maximizing your return on investment and starting your new career on a solid footing. This section Artikels strategies for repaying loans or ISAs and securing employment to cover your bootcamp costs.

Planning for repayment requires a proactive and organized approach. This involves understanding your total debt, creating a realistic budget, and exploring various repayment options. Effective budgeting is paramount to successfully managing your finances after the bootcamp.

Repayment Strategies for Loans and ISAs

Creating a detailed repayment plan is essential for managing your post-bootcamp debt. This plan should include a clear understanding of your loan terms (interest rates, repayment periods, etc.) or ISA terms (income share percentage, repayment duration). Consider using budgeting apps or spreadsheets to track your income and expenses, ensuring consistent payments. Prioritize high-interest debt to minimize long-term costs. For example, you could allocate a specific portion of your monthly income towards debt repayment, aiming for the minimum payment or more depending on your financial situation. Explore options like debt consolidation or refinancing to potentially lower interest rates and simplify repayment.

Resources for Managing Student Loan Debt

Several resources can assist in managing student loan debt. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, helping individuals create personalized debt management plans. Similarly, many non-profit organizations provide guidance and support for navigating student loan repayment. Government websites often contain detailed information on repayment plans, including income-driven repayment options that adjust payments based on your income. These resources provide valuable tools and strategies for effective debt management.

Job Search Strategies for Covering Bootcamp Costs

Securing a well-paying job is crucial for covering bootcamp costs. A targeted job search strategy is essential. This involves identifying companies known for hiring bootcamp graduates, tailoring your resume and cover letter to highlight relevant skills, and networking with professionals in the industry. Actively using online job boards, attending industry events, and leveraging your bootcamp’s alumni network can significantly increase your chances of finding suitable employment. For instance, focusing your search on companies that utilize the specific technologies you learned in the bootcamp will maximize your chances of success. Consider creating a portfolio of projects to showcase your skills and capabilities to potential employers.

Return on Investment (ROI) of a Coding Bootcamp, How to pay for a coding bootcamp

The ROI of a coding bootcamp is highly dependent on factors like the bootcamp’s reputation, your job search efforts, and the job market. However, the potential for a high ROI is significant. A successful job search can lead to a substantial increase in earning potential, quickly offsetting the bootcamp’s costs. For example, a graduate might secure a role with a starting salary significantly higher than their previous earnings, resulting in a positive ROI within a few years. While there are no guarantees, a well-planned career path, combined with diligent job searching, significantly increases the likelihood of a favorable return on investment. Consider researching average salaries for roles within your chosen field to estimate your potential earnings.

Tim Redaksi