Alternatives to Student Loans for Bootcamp Funding

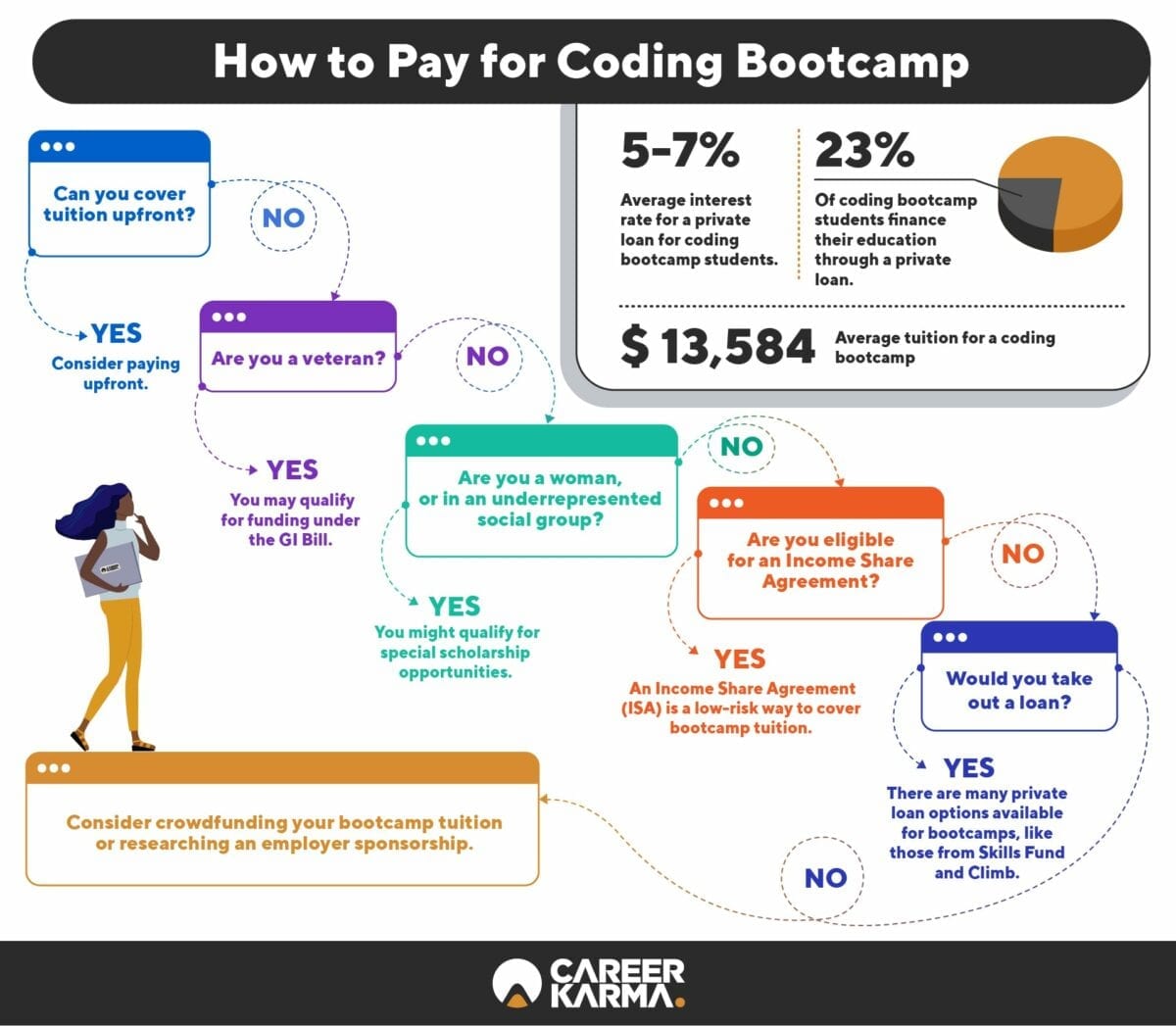

Securing funding for a coding bootcamp can be a significant hurdle. While student loans are a common route, several alternatives offer viable pathways, each with its own set of advantages and disadvantages. Exploring these options can lead to a more financially responsible and potentially less burdensome approach to financing your education. This section details several alternatives, outlining their application processes and comparing them to traditional student loans.

Scholarships and Grants

Many organizations offer scholarships and grants specifically for individuals pursuing coding bootcamps or related technology education. These awards typically don’t require repayment, unlike loans. Finding these opportunities often involves researching specific bootcamps (many offer their own internal scholarships), technology companies, and non-profit organizations focused on tech education and diversity in tech. Eligibility requirements vary widely, but often include factors such as academic merit, demonstrated financial need, or belonging to a specific demographic group. The application process usually involves submitting an application form, transcripts, essays, and letters of recommendation. Some grants may require additional documentation, such as tax returns to demonstrate financial need.

Employer Sponsorships

Increasingly, employers are recognizing the value of upskilling their workforce and are willing to sponsor employees’ participation in coding bootcamps. This sponsorship can cover all or a portion of the bootcamp tuition. The advantages are clear: reduced financial burden and the potential for immediate employment upon graduation with the sponsoring company. However, this option is contingent upon current employment and the employer’s willingness to invest in employee development. Eligibility usually requires a certain tenure with the company and a demonstrated commitment to career advancement within the organization. The application process typically involves internal application within the company, followed by approval from management and HR.

Income Share Agreements (ISAs), Can you get a student loan for coding bootcamp

Income Share Agreements are a relatively new financing option. With an ISA, you don’t pay a fixed tuition fee upfront. Instead, you agree to pay a percentage of your income for a set period after you secure a job above a certain salary threshold. This structure aligns the bootcamp’s success with your own, making it beneficial for both parties. However, the total repayment amount can be unpredictable, and it could extend for several years. Eligibility criteria for ISAs vary depending on the provider and may involve credit checks and income verification. The application process usually involves a detailed application form and potentially an interview.

Personal Savings and Family Contributions

Using personal savings or seeking financial assistance from family members is a straightforward option. This eliminates the debt associated with loans and ISAs, and allows for more control over your financing. However, this option may not be feasible for everyone, and it requires significant personal financial planning and budgeting. The application process is essentially self-directed, involving saving diligently and communicating financial needs to family members.

| Funding Option | Advantages | Disadvantages | Application Process |

|---|---|---|---|

| Student Loans | Covers full tuition; relatively easy access | Accumulates debt; interest payments; impacts credit score | Application through lender; credit check required |

| Scholarships/Grants | No repayment; can significantly reduce costs | Competitive; requires strong application; limited availability | Application through sponsoring organization; essay/recommendation often required |

| Employer Sponsorship | No out-of-pocket cost; potential for immediate employment | Requires current employment; dependent on employer policy | Internal company application; management approval |

| Income Share Agreements (ISAs) | No upfront cost; repayment tied to income | Unpredictable total repayment; repayment period can be lengthy | Application through ISA provider; income verification required |

| Personal Savings/Family Contributions | No debt; full control over financing | Requires significant savings; may not be feasible for all | Self-directed; requires budgeting and family communication |

Potential Risks and Considerations: Can You Get A Student Loan For Coding Bootcamp

Taking out student loans to finance a coding bootcamp can be a significant financial decision with potential long-term implications. While a bootcamp can lead to a rewarding career, it’s crucial to carefully weigh the benefits against the risks associated with borrowing money. Failing to do so could lead to considerable financial strain and potentially hinder your career goals rather than help them.

Understanding the financial landscape of student loans for bootcamps is paramount. This includes not only the immediate cost of tuition but also the long-term implications of accumulating debt, including interest accrual and repayment schedules. A thorough understanding of these factors will empower you to make an informed decision.

High Interest Rates and Debt Burden

Coding bootcamp loans often carry higher interest rates compared to traditional federal student loans. These rates can significantly increase the total amount you repay over the life of the loan. For example, a loan of $15,000 with a 10% interest rate will cost substantially more than the same loan with a 5% interest rate. The resulting debt burden can be substantial, impacting your ability to save for other goals, such as a down payment on a house or investing in your future. Careful budgeting and realistic repayment planning are essential to mitigate this risk.

Loan Agreement Terms and Conditions

It is imperative to thoroughly read and understand the terms and conditions of any student loan agreement before signing. This includes the interest rate, repayment schedule, grace period (if any), and any penalties for late or missed payments. Understanding these details will allow you to make informed decisions about your financial future and avoid unexpected surprises down the line. A common oversight is failing to grasp the implications of deferment or forbearance options, which can temporarily postpone payments but may ultimately increase the total amount owed.

Consequences of Defaulting on Student Loan Payments

Defaulting on student loan payments can have severe consequences, including damage to your credit score, wage garnishment, and even legal action. A poor credit score can make it difficult to obtain future loans, rent an apartment, or even secure certain jobs. Wage garnishment involves a portion of your paycheck being automatically deducted to repay the loan, which can significantly impact your monthly budget. In extreme cases, legal action may be taken to recover the outstanding debt. Therefore, responsible financial planning and proactive communication with your lender are critical to avoid default.

Crucial Questions to Ask Before Taking Out a Loan

Before committing to a student loan for a coding bootcamp, it’s essential to ask yourself several key questions:

- What is the total cost of the bootcamp, including tuition, fees, and living expenses?

- What are the interest rates and repayment terms for available student loans?

- What is my projected income after completing the bootcamp, and can I realistically afford the monthly loan payments?

- What are my alternative funding options, and how do they compare to student loans?

- What is the bootcamp’s job placement rate and average salary for graduates?

- What is the lender’s policy regarding deferment or forbearance in case of unforeseen circumstances?

- What are the consequences of defaulting on the loan, and how can I avoid this scenario?

Tim Redaksi