Documentation Requirements for 529 Plan Reimbursement

Using a 529 plan to pay for a coding bootcamp can offer significant tax advantages. However, successfully claiming reimbursement requires meticulous record-keeping and the submission of accurate documentation. Understanding the specific requirements of your plan provider is crucial for a smooth process.

Step-by-Step Claim Submission Process

Submitting a claim for reimbursement typically involves several steps. First, you’ll need to gather all the necessary documentation (detailed below). Next, you’ll complete the reimbursement request form provided by your 529 plan administrator. This form will usually require information about the beneficiary, the educational institution, the expenses incurred, and the amount of reimbursement sought. After completing the form, submit it along with all supporting documentation through the method specified by your plan administrator – this might be through mail, online portal, or fax. Finally, you’ll need to wait for processing, which can take several weeks. Always keep copies of all submitted documents for your records.

Required Documents for Reimbursement

It’s vital to assemble all necessary documentation before submitting your claim. Missing documents can significantly delay the process or even lead to rejection. The specific requirements may vary slightly depending on your plan provider, so always consult your plan documents or contact your administrator for clarification.

Acceptable Documentation and Purposes

| Document Type | Purpose | Example | Required? |

|---|---|---|---|

| Coding Bootcamp Acceptance Letter | Verifies enrollment in a qualified educational program. | Official letter from the bootcamp confirming acceptance and program details. | Yes |

| Tuition Invoice/Statement | Shows the total cost of tuition and any associated fees. | Detailed invoice from the bootcamp specifying the amount paid for tuition. | Yes |

| Proof of Payment | Demonstrates that the tuition fees have been paid. | Bank statement showing the payment transaction, or a canceled check. | Yes |

| 529 Plan Account Statement | Shows the available funds in the 529 plan account. | Statement from your 529 plan provider showing the account balance. | Yes |

| Beneficiary’s Social Security Number | Identifies the beneficiary of the 529 plan. | A copy of the beneficiary’s Social Security card (or other valid identification). | Yes |

| Bootcamp Course Catalog or Curriculum | Demonstrates the educational nature of the program. | A copy of the bootcamp’s course catalog outlining the program’s curriculum. | May be required |

Consequences of Insufficient Documentation

Failure to provide all the necessary documentation can result in delays in processing your reimbursement claim. In some cases, incomplete documentation may lead to the rejection of your claim entirely, meaning you won’t receive the funds you were expecting. It’s crucial to be proactive and thorough in gathering and submitting all required documents to ensure a smooth and successful reimbursement process. Contacting your 529 plan administrator beforehand to clarify any uncertainties is always advisable.

Cost Considerations and 529 Plan Usage

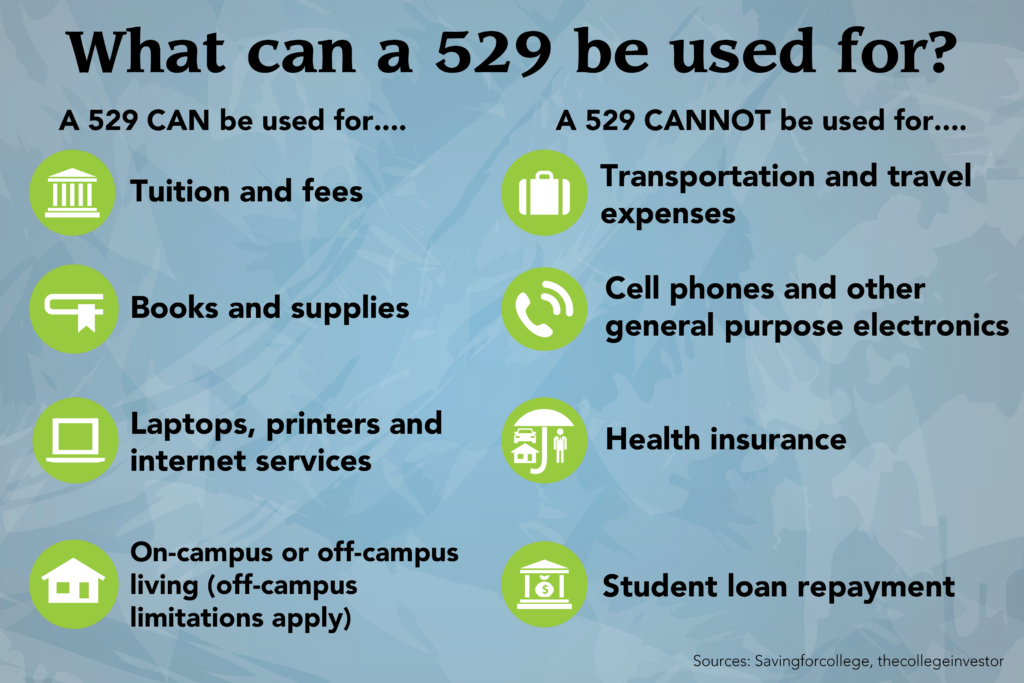

Planning to fund a coding bootcamp with a 529 plan requires careful consideration of costs and eligibility rules. Understanding the typical expenses involved and how 529 plans can help offset them is crucial for maximizing the educational benefit. This section will Artikel these key aspects.

Typical Coding Bootcamp Costs

Coding bootcamps vary significantly in price, influenced by factors such as program length, location, specialization, and the reputation of the institution. Tuition fees typically range from $10,000 to $20,000, but some intensive or specialized programs can exceed $30,000. Additional costs include application fees, books and materials, and potentially travel expenses if the bootcamp is not locally situated. Living expenses, such as rent, utilities, and food, must also be factored into the overall budget. For example, a student attending a bootcamp in a high-cost-of-living city like San Francisco might face significantly higher living expenses than someone attending a bootcamp in a smaller city. These combined costs can easily reach $30,000 to $50,000 or more, depending on individual circumstances.

Calculating Maximum 529 Plan Withdrawals

The maximum amount you can withdraw from a 529 plan for qualified education expenses, including coding bootcamps, is determined by the total qualified expenses incurred. This means you can withdraw up to the actual cost of tuition, fees, and other allowable expenses. Crucially, withdrawals used for qualified education expenses are tax-free at both the federal and state levels. However, any amount withdrawn exceeding the actual qualified expenses will be subject to both income tax and a 10% penalty. Therefore, careful budgeting and accurate expense tracking are essential to avoid unnecessary tax implications. For instance, if a student’s total qualified expenses for a bootcamp are $15,000, they can withdraw up to $15,000 from their 529 plan without penalty.

Comparison of Coding Bootcamp Costs and 529 Eligibility

The following table compares different types of coding bootcamps, their average costs, 529 plan eligibility, and potential tax implications. Note that these are average figures and can vary based on the specific institution and program.

| Bootcamp Type | Average Cost | 529 Eligibility | Tax Implications |

|---|---|---|---|

| Full-Time Immersive | $15,000 – $20,000 | Generally Eligible | Tax-free withdrawals for qualified expenses |

| Part-Time | $8,000 – $15,000 | Generally Eligible | Tax-free withdrawals for qualified expenses |

| Online Bootcamp | $10,000 – $18,000 | Generally Eligible | Tax-free withdrawals for qualified expenses |

| Specialized Bootcamp (e.g., Data Science) | $18,000 – $30,000+ | Generally Eligible | Tax-free withdrawals for qualified expenses |

Strategies for Maximizing 529 Plan Usage

To maximize the use of 529 plan funds for coding bootcamp expenses, it’s recommended to carefully plan and document all eligible expenses. This includes maintaining detailed records of tuition payments, fees, books, and other qualified educational materials. It is also wise to explore all available financial aid options, scholarships, and grants to potentially reduce the overall cost of the bootcamp and therefore the amount needing to be covered by the 529 plan. Early planning and accurate expense tracking are crucial for ensuring efficient and penalty-free use of 529 plan funds. Furthermore, understanding the specific rules and regulations of your state’s 529 plan is important to avoid any potential issues.

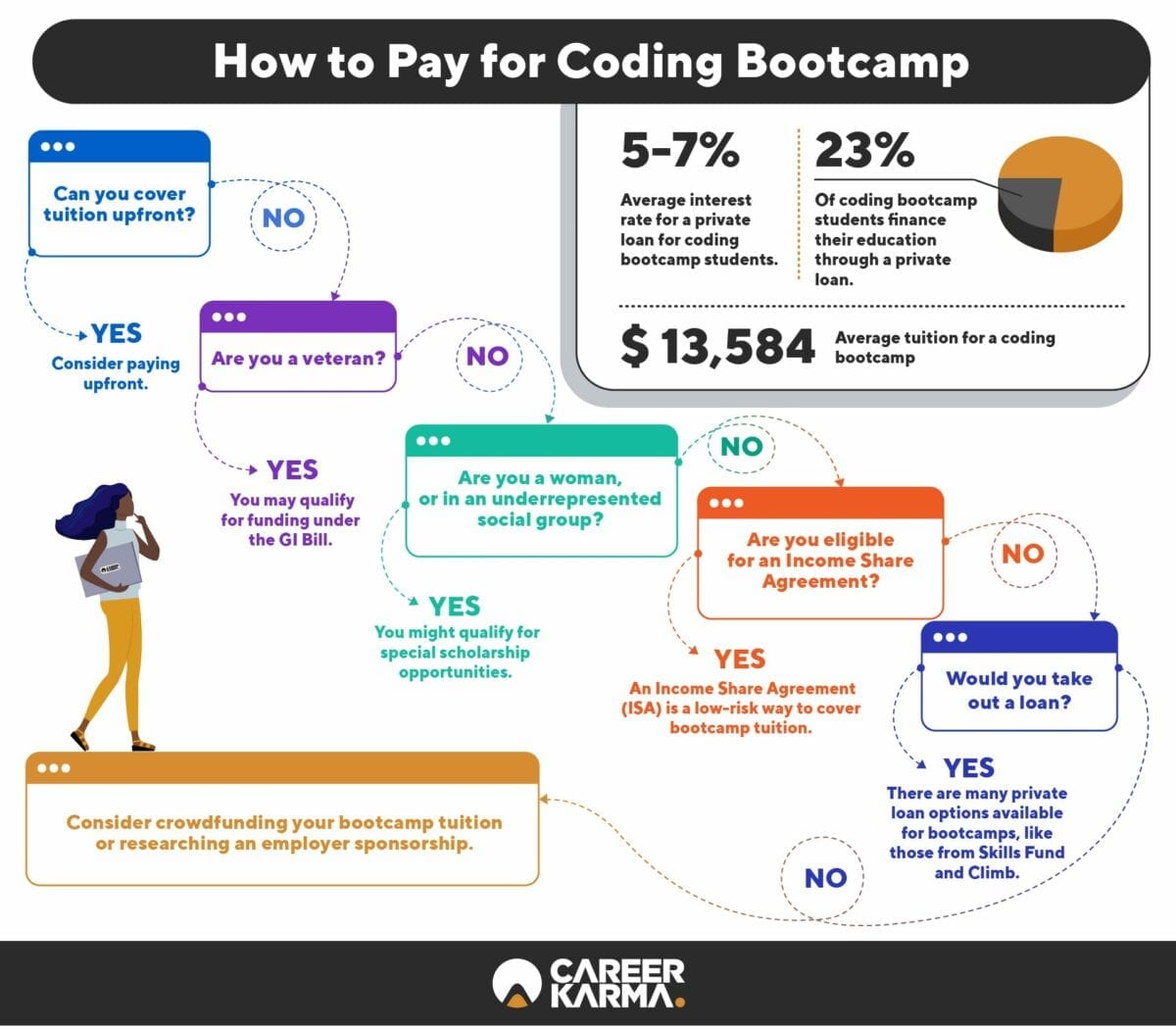

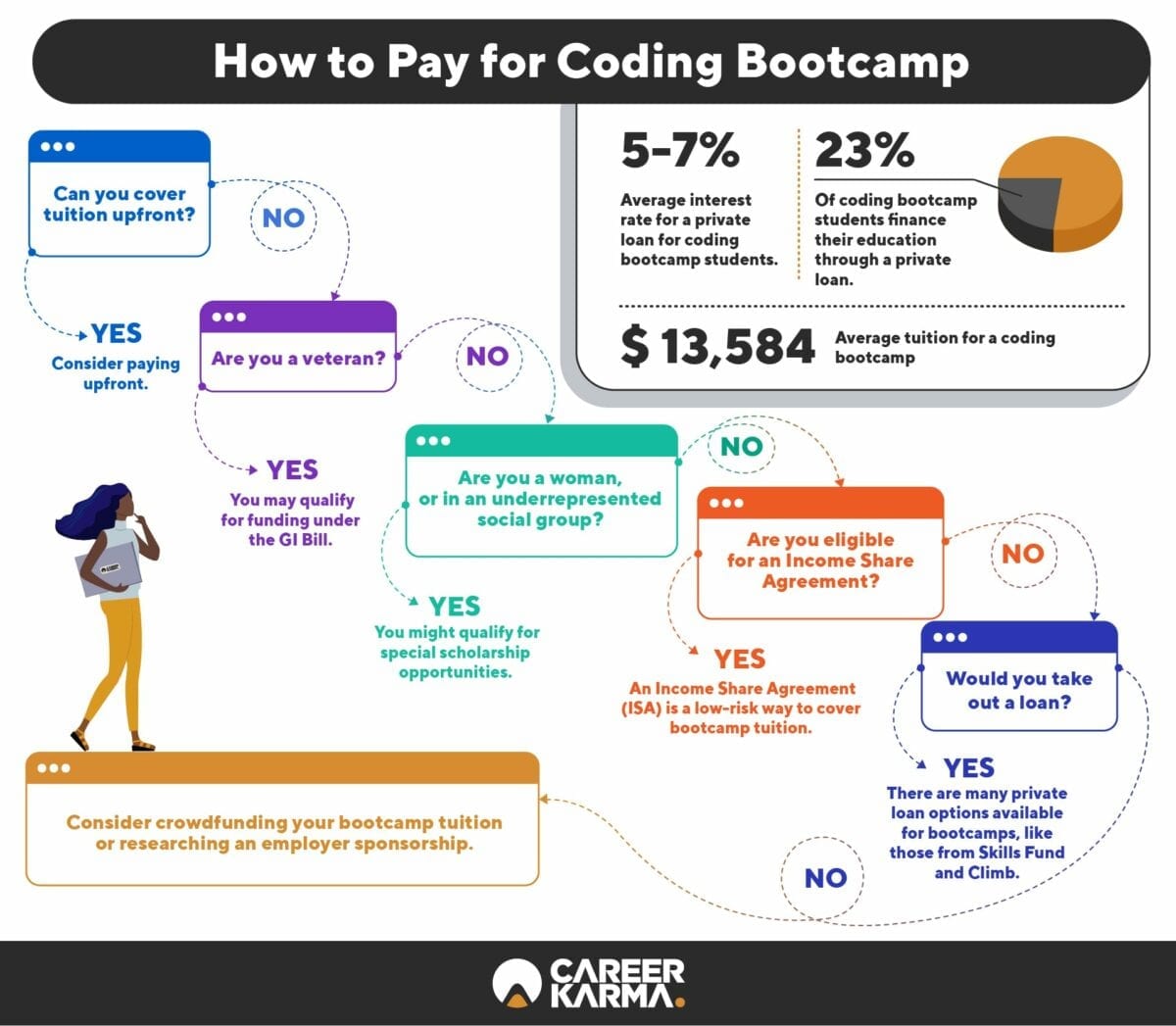

Alternatives to 529 Plans for Coding Bootcamp Funding: Can You Use 529 For Coding Bootcamp

Securing funding for a coding bootcamp is a crucial step in launching a tech career. While 529 plans offer tax advantages, they aren’t the only avenue for financing your education. Exploring alternative options allows you to choose the best fit for your financial situation and circumstances.

Can you use 529 for coding bootcamp – Several alternatives to 529 plans exist, each with its own set of benefits and drawbacks. Carefully weighing these options is essential to make an informed decision about how to pay for your bootcamp.

Personal Savings, Can you use 529 for coding bootcamp

Personal savings represent a readily available funding source. Using your own money eliminates the need for loans or complex application processes. However, the amount available will vary greatly depending on individual circumstances. This method is advantageous for those who have diligently saved for educational expenses. The disadvantage is the potential for delaying bootcamp enrollment if sufficient savings aren’t yet accumulated.

Loans

Various loan options cater to students pursuing coding bootcamps. Federal student loans may not directly cover bootcamps, but private lenders often offer specialized programs. These loans provide flexibility but come with interest charges that accumulate over time. The application process may involve credit checks and require co-signers depending on the applicant’s credit history. It’s crucial to carefully compare interest rates and repayment terms before committing to a loan.

Scholarships

Numerous scholarships specifically target individuals entering the tech field. These scholarships can significantly reduce the financial burden of bootcamp tuition. Many organizations, including bootcamps themselves, offer scholarships based on merit, financial need, or specific demographics. The application processes vary, often requiring essays, transcripts, and letters of recommendation. The competition for scholarships can be intense, and securing funding depends on meeting the specific criteria of each program.

Comparison of Funding Options

| Funding Option | Advantages | Disadvantages |

|---|---|---|

| 529 Plan | Tax advantages, potential for growth | Limited flexibility, may not cover all expenses |

| Personal Savings | No interest, readily available | May require significant savings, potential delay in enrollment |

| Loans | Flexibility, covers tuition costs | Accumulates interest, potential for debt |

| Scholarships | Reduces or eliminates tuition costs | Competitive application process, limited availability |

Scholarship Application Process and Requirements

The application process for coding bootcamp scholarships varies significantly depending on the provider. Generally, applications require detailed personal information, academic transcripts (if applicable), resumes, essays highlighting career goals and financial need, and sometimes letters of recommendation. Specific requirements are Artikeld on each scholarship provider’s website. Many scholarships focus on underrepresented groups in tech or individuals with specific skills or experiences. Thorough research and early application are crucial to maximize chances of securing funding.

Decision-Making Flowchart for Choosing a Funding Option

A flowchart would visually represent the decision-making process. Starting with assessing available personal savings, it would branch to loan options if savings are insufficient. If loans are undesirable, it would then direct the individual to explore scholarship opportunities. Each branch would incorporate considerations like credit score, loan terms, and scholarship eligibility criteria, ultimately leading to a chosen funding method.

State-Specific Regulations on 529 Plan Usage

The use of 529 plans to pay for coding bootcamps is not uniformly regulated across all states. While the federal government sets broad guidelines, individual states often have their own interpretations and restrictions on what qualifies as an eligible educational expense under their 529 plans. This can lead to significant variations in how these plans can be utilized for non-traditional educational programs like coding bootcamps. Understanding these state-specific regulations is crucial for individuals considering using their 529 plans for this purpose.

State-specific regulations regarding 529 plan usage for coding bootcamps primarily revolve around the definition of “qualified education expenses.” Some states have broader interpretations, encompassing a wider range of educational programs, including vocational training and professional development courses. Others maintain stricter definitions, limiting eligible expenses to traditional college degree programs. This difference significantly affects whether a coding bootcamp would be considered a valid expense. Further, the specific wording within each state’s plan document can lead to inconsistencies in interpretation and application.

Examples of State Regulations

Several states demonstrate the range of approaches to 529 plan usage for non-traditional education. For instance, some states explicitly list coding bootcamps as eligible expenses, while others might require the bootcamp to be accredited by a specific agency or to meet certain criteria concerning program length or curriculum. Conversely, some states may explicitly exclude such programs from 529 plan eligibility. The lack of consistent nationwide guidelines necessitates careful examination of each state’s specific rules and regulations.

State-by-State Comparison of 529 Plan Regulations

The following table summarizes key differences in 529 plan regulations across several states. Note that this information is for illustrative purposes and should not be considered exhaustive or legal advice. Always consult the official plan documents and relevant state regulations for the most accurate and up-to-date information.

| State | Eligibility Criteria | Maximum Contribution | Tax Benefits |

|---|---|---|---|

| California | Generally follows federal guidelines; specific bootcamp eligibility varies depending on accreditation and program specifics. | Varies depending on the specific plan; check plan documents. | State tax deduction may apply. |

| New York | Generally requires programs to be accredited or meet certain standards; explicit inclusion or exclusion of bootcamps is unclear and requires careful review of plan documents. | Varies depending on the specific plan; check plan documents. | State tax deduction may apply. |

| Florida | Generally broad interpretation of qualified education expenses; some bootcamps might qualify. | Varies depending on the specific plan; check plan documents. | No state income tax, therefore no state tax benefits directly related to 529 plans. |

| Texas | Generally follows federal guidelines; bootcamp eligibility needs careful review of specific plan documents. | Varies depending on the specific plan; check plan documents. | State tax deduction may apply. |

Implications of Interstate Movement

Moving between states can complicate the use of 529 plans for coding bootcamp expenses. If a family relocates, the rules governing their 529 plan will change to reflect the new state’s regulations. This might mean that expenses previously considered eligible may no longer qualify, or vice-versa. Furthermore, tax benefits associated with 529 plans are often state-specific, meaning a change of residence could impact the tax advantages of using the plan. It’s crucial to understand the implications of interstate moves on 529 plan eligibility before relocating. Careful planning and consultation with a financial advisor are highly recommended in such scenarios.

Tim Redaksi