Scholarships and Grants

Funding a coding bootcamp can be a significant investment, but numerous scholarships and grants can help alleviate the financial burden. These opportunities are often offered by organizations dedicated to promoting diversity in tech or supporting individuals pursuing career transitions. Securing funding requires diligent research and a well-crafted application.

Securing funding for a coding bootcamp through scholarships and grants involves identifying relevant organizations, understanding their criteria, and crafting compelling applications. Many organizations prioritize specific demographics or career goals, so tailoring your application to each opportunity is crucial. Thorough research and careful preparation significantly increase your chances of success.

Reputable Organizations Offering Coding Bootcamp Scholarships

Several organizations offer scholarships specifically designed to support individuals attending coding bootcamps. These organizations often have varying eligibility criteria and application processes. Researching and applying to multiple organizations increases your chances of receiving funding.

- Career Karma: Offers a range of scholarships for various bootcamps and learning programs, often focusing on underrepresented groups in tech.

- The Guild Education: Partners with companies to provide tuition assistance and scholarships for employees pursuing upskilling and reskilling opportunities, including coding bootcamps.

- Thinkful: While primarily a bootcamp provider, Thinkful also offers scholarships to qualified applicants based on financial need and demonstrated commitment to learning.

- Codecademy: Provides scholarships and financial aid options through various partnerships and initiatives, often targeted towards specific demographics or learning goals.

- Individual Bootcamp Providers: Many coding bootcamps offer their own internal scholarships. Check the websites of bootcamps you’re interested in for specific opportunities.

Scholarship Application Criteria and Procedures

Each organization will have unique criteria and procedures for their scholarships. Common criteria include demonstrated financial need, academic merit, career goals, and commitment to the tech industry. Application procedures typically involve submitting an application form, transcripts (if applicable), letters of recommendation, and a personal essay. Meeting all requirements is crucial for consideration.

Tips for Writing a Compelling Scholarship Application Essay

The essay is often the most critical part of the application. It allows you to showcase your personality, motivations, and qualifications. A strong essay demonstrates your understanding of the opportunity, highlights your commitment, and articulates your future goals.

- Clearly articulate your goals: Explain why you want to attend the bootcamp and how it aligns with your career aspirations.

- Demonstrate financial need (if applicable): Provide specific details about your financial situation, emphasizing the impact the scholarship would have.

- Highlight relevant experiences: Showcase experiences that demonstrate your skills, perseverance, and commitment to learning.

- Proofread meticulously: Errors in grammar and spelling can negatively impact your application.

- Tailor your essay to each scholarship: Address the specific criteria and priorities of each organization in your essay.

Income Share Agreements (ISAs)

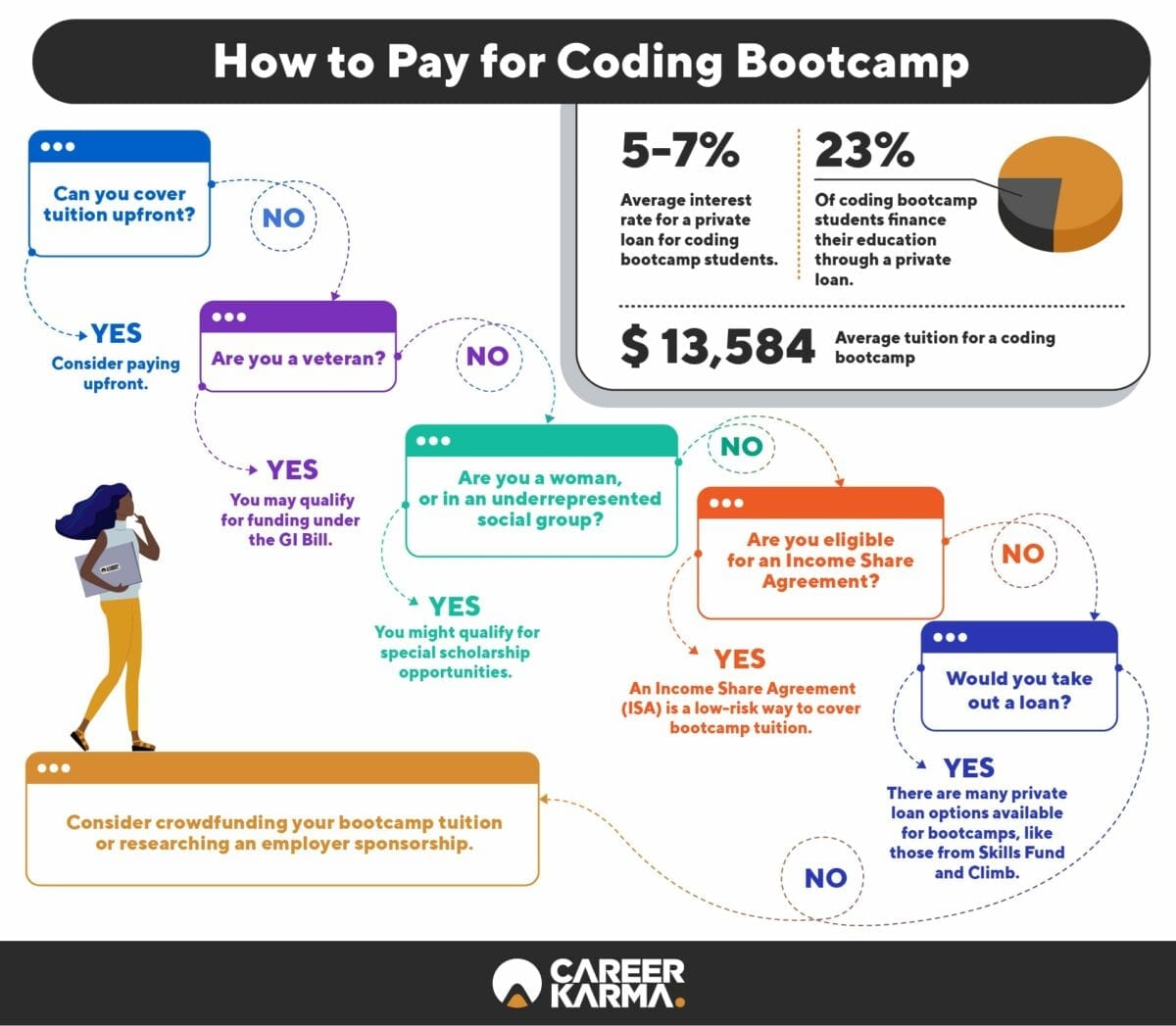

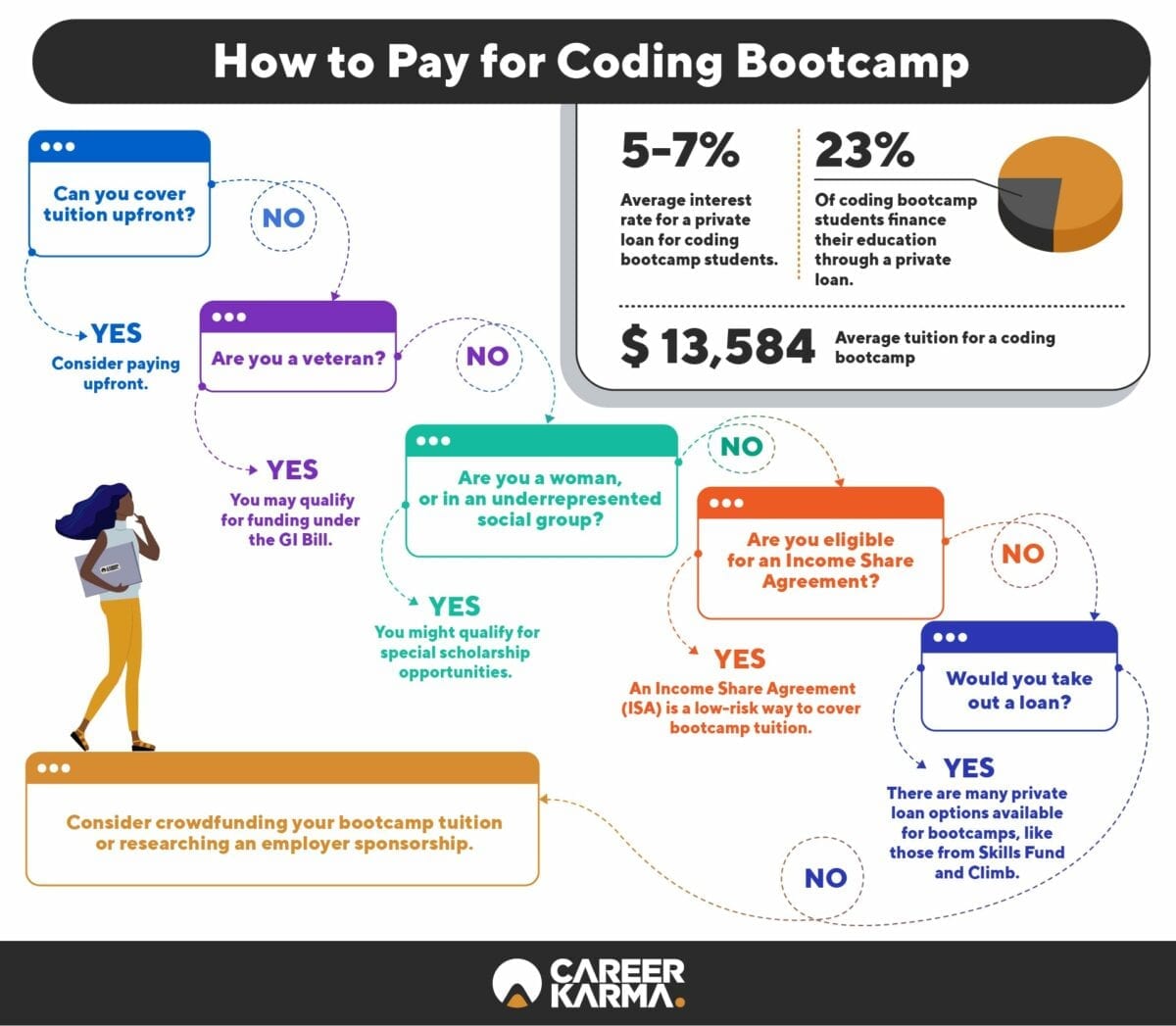

Income Share Agreements (ISAs) offer an alternative financing option for coding bootcamps, differing significantly from traditional loans. Instead of borrowing a lump sum and paying it back with interest, you agree to pay a percentage of your post-bootcamp income for a set period. This approach links repayment directly to your success, making it potentially less risky than traditional loans, but also introduces complexities.

ISAs present both advantages and disadvantages.

Advantages and Disadvantages of ISAs

ISAs can be appealing because the repayment amount is tied to your income. If you secure a high-paying job after the bootcamp, your payments will be larger, but if you struggle to find employment or your salary is lower than anticipated, your payments will be proportionally smaller or even nonexistent. However, this income-contingent repayment also presents a downside. If your income remains low for an extended period, you could be paying back your ISA for a considerable time, potentially paying more overall than you would with a traditional loan with a fixed interest rate. Furthermore, the percentage of your income paid and the repayment period are pre-determined, meaning you are locked into an agreement that might not align perfectly with your future financial circumstances. Finally, ISAs might not be available from all bootcamps, limiting your options.

ISA Repayment Structure and Influencing Factors

The repayment structure of an ISA typically involves a fixed percentage of your post-bootcamp income paid over a specific number of months or years. The percentage and repayment period are established in the agreement before you start the bootcamp. Several factors influence the repayment amount. The most significant is your post-bootcamp income. Higher earnings directly translate into higher payments. The length of the repayment period also plays a crucial role; longer repayment periods result in smaller individual payments, but overall you will pay back more. The initial agreed-upon percentage of income contributed also heavily influences the final amount paid. Finally, some ISAs may include a minimum or maximum payment threshold.

Example ISA Calculation

Let’s consider an example. Suppose a bootcamp offers an ISA where you agree to pay 15% of your gross monthly income for 36 months after graduation. If, after completing the bootcamp, you secure a job paying $6,000 per month, your monthly ISA payment would be $900 ($6,000 x 0.15). Over the 36-month repayment period, your total repayment would be $32,400 ($900 x 36). However, if your monthly income was only $4,000, your monthly payment would be $600, and your total repayment would be $21,600. This example highlights the income-contingent nature of ISAs. The total repayment amount fluctuates based on your post-bootcamp income, offering both potential benefits and risks. It is crucial to carefully review the terms of any ISA before committing.

Employer Sponsorship and Tuition Reimbursement

Securing funding for a coding bootcamp can be challenging, but many employers recognize the value of upskilling their workforce and offer tuition reimbursement programs. This can significantly reduce or even eliminate the financial burden of attending a bootcamp, making it a viable option for many aspiring developers. Let’s explore how employer sponsorship can help fund your coding education.

Employer-sponsored training, including tuition reimbursement for coding bootcamps, is a valuable benefit offered by many companies seeking to enhance their employees’ skills and keep their workforce competitive. This benefit typically covers a portion or all of the bootcamp’s tuition fees, sometimes including associated costs like books and materials. The specific terms and conditions vary greatly depending on the employer and their policies.

Companies Offering Tuition Reimbursement, How to pay for coding bootcamp

Many large technology companies, as well as companies in other industries that utilize software development, frequently offer tuition reimbursement programs. Examples include Google, Amazon, Microsoft, and Salesforce, known for their robust employee development initiatives. However, numerous smaller companies and even startups also offer such benefits, albeit perhaps with different eligibility criteria or reimbursement amounts. It’s crucial to research the specific policies of companies you’re interested in working for or are already employed by.

Requirements and Application Processes for Employer-Sponsored Training

The requirements and application processes for employer-sponsored training vary significantly across companies. Generally, eligibility often hinges on factors such as length of employment (a minimum tenure is frequently required), performance reviews (demonstrating consistent competence and commitment), and the relevance of the training to the employee’s current role or future career path within the company. The application process typically involves submitting a formal proposal outlining the chosen bootcamp, its curriculum, and how the acquired skills will benefit the company. This proposal often requires approval from a supervisor or manager, followed by the completion of necessary paperwork and potentially an interview to justify the investment. Some companies may have a pre-approved list of training providers or courses, while others may offer more flexibility in course selection.

Sample Email Requesting Tuition Reimbursement Information

To inquire about tuition reimbursement options, a well-crafted email is essential. Here’s a sample email you can adapt:

Subject: Inquiry Regarding Tuition Reimbursement for Coding Bootcamp

Dear [Manager’s Name],

I am writing to inquire about the company’s tuition reimbursement program. I am interested in attending [Bootcamp Name], a [type of bootcamp, e.g., full-stack web development] bootcamp, to enhance my skills in [specific skill]. I believe this training would significantly benefit my current role at [Company Name] by [explain how, e.g., improving efficiency, developing new features, etc.]. Could you please provide me with information on the eligibility requirements and application process for tuition reimbursement?

Thank you for your time and consideration.

Sincerely,

[Your Name]

Veterans Benefits and Funding: How To Pay For Coding Bootcamp

Many veterans are eligible to use their GI Bill benefits to fund coding bootcamps, providing a valuable opportunity to transition into high-demand tech careers. This section details the eligibility requirements and application process for accessing these educational benefits.

Eligibility for using GI Bill benefits for coding bootcamps depends primarily on the specific type of GI Bill you have and whether the bootcamp meets the Department of Veterans Affairs (VA) requirements. Generally, the Post-9/11 GI Bill is the most commonly used for this purpose, offering significant funding for approved educational programs. However, other GI Bill chapters may also apply, depending on your service history and eligibility criteria. It’s crucial to verify your specific eligibility with the VA directly.

Eligibility Requirements for Veterans

To utilize GI Bill benefits for a coding bootcamp, veterans must meet several criteria. These include having an approved Certificate of Eligibility (COE), having sufficient remaining GI Bill benefits, and attending a VA-approved bootcamp. The bootcamp must be accredited or have received an approval from the VA. Specific requirements may vary depending on the veteran’s service history and the chosen GI Bill chapter. For instance, the Post-9/11 GI Bill requires a minimum of 90 days of active duty service, while other chapters may have different service requirements. Contacting the VA directly will provide personalized eligibility information.

Applying for and Receiving Veterans’ Educational Benefits

The application process involves several steps. First, veterans need to obtain their Certificate of Eligibility (COE) from the Department of Veterans Affairs (VA). This document verifies their eligibility for educational benefits. Next, they must select a VA-approved coding bootcamp. It is essential to confirm that the bootcamp is on the VA’s list of approved programs. Once a bootcamp is chosen, the veteran will need to submit their COE and other required documentation to the bootcamp and the VA to begin receiving benefits. This may include transcripts, proof of identity, and enrollment paperwork. The VA will then process the application and, if approved, will begin disbursing educational benefits to the bootcamp or directly to the veteran, depending on the program structure. The timing of receiving benefits can vary depending on the VA’s processing time and the specific details of the application.

Flowchart: Using Veterans’ Benefits for Bootcamp Tuition

The following flowchart visually represents the steps involved:

[Diagram description: A flowchart showing the process. It begins with “Veteran with GI Bill Eligibility?” A “Yes” branch leads to “Obtain Certificate of Eligibility (COE) from VA”. This leads to “Select VA-Approved Bootcamp”. Then “Submit COE and enrollment paperwork to Bootcamp and VA”. This leads to “VA processes application”. A “Yes” branch from “Approved?” leads to “Receive Educational Benefits”. A “No” branch from “Approved?” leads to “Appeal or re-apply”. A “No” branch from “Veteran with GI Bill Eligibility?” leads to “Explore other funding options”.]

Alternative Funding Sources (Crowdfunding, Personal Loans)

Securing funding for a coding bootcamp can be challenging, even after exploring traditional avenues like scholarships and employer assistance. Fortunately, alternative financing options exist, each with its own set of advantages and disadvantages. Understanding these options allows you to make an informed decision about the best path for your specific circumstances.

Crowdfunding and personal loans represent two distinct approaches to securing the necessary funds. While both can provide the capital needed, they differ significantly in their structure, risks, and long-term financial implications.

Crowdfunding for Coding Bootcamp Tuition

Crowdfunding platforms offer a way to raise money from a large network of individuals, often friends, family, and even strangers, who contribute smaller amounts. Successful campaigns often involve a compelling narrative outlining the individual’s goals, the impact of the coding bootcamp on their future, and a clear plan for utilizing the funds. While crowdfunding can be effective in raising significant funds, it’s crucial to carefully weigh the pros and cons.

- Pros: Crowdfunding can potentially raise a substantial amount of money without accruing debt. It also offers the opportunity to build community and gain support from a wider network.

- Cons: Success is not guaranteed. Campaigns require significant effort in marketing and outreach. Publicly sharing financial needs can be uncomfortable for some individuals. Furthermore, the funds raised are not guaranteed and are dependent on the success of the campaign.

Personal Loans: Banks vs. Credit Unions

Personal loans from banks and credit unions can provide a more predictable funding source compared to crowdfunding. However, it’s essential to understand the differences between these institutions and the implications of borrowing money.

- Banks: Typically offer a wider range of loan products but may have stricter lending criteria and potentially higher interest rates. The application process might also be more complex.

- Credit Unions: Often offer more favorable interest rates and more flexible loan terms, particularly for members. They frequently prioritize community involvement and may offer personalized service.

Risks and Drawbacks of High-Interest Loans

High-interest loans, while potentially providing quick access to funds, come with significant risks. These loans can trap borrowers in a cycle of debt, especially if unexpected expenses arise or if the individual struggles to find employment after completing the bootcamp.

- High Monthly Payments: High-interest loans can lead to substantial monthly payments, straining personal finances. A realistic budget assessment is crucial before committing to such a loan.

- Debt Accumulation: Failing to make timely payments can result in penalties, late fees, and further accumulation of debt, potentially impacting credit scores and future borrowing opportunities.

- Impact on Future Financial Goals: Significant debt can hinder other financial goals, such as saving for a down payment on a house or investing in retirement.

For example, a $15,000 loan with a 20% interest rate could result in significantly higher total repayment costs compared to a loan with a lower interest rate. Careful consideration of the total cost of borrowing is essential before committing to a high-interest loan. Borrowers should explore all available options and compare interest rates, fees, and repayment terms before making a decision.

Tim Redaksi