Documentation and Record Keeping

Meticulous record-keeping is crucial for successfully claiming the tax deduction for your coding bootcamp tuition. Maintaining organized documentation not only simplifies the tax filing process but also provides irrefutable evidence of your expenses should you be audited. Failing to keep proper records could result in the denial of your deduction.

Proper documentation ensures you can accurately report your coding bootcamp expenses on your tax return, maximizing your potential tax savings. This process involves collecting and organizing various documents that substantiate your claim. The IRS requires taxpayers to maintain sufficient records to support any deductions claimed.

Essential Documents for Tax Purposes

Maintaining a comprehensive collection of documents is essential for supporting your tax deduction. These documents serve as proof of your expenses and the educational nature of the bootcamp. Without them, claiming the deduction becomes significantly more difficult, if not impossible.

- Tuition Receipts: These receipts should clearly show the date of payment, the amount paid, and a description of the payment (e.g., “Tuition for Full-Stack Web Development Bootcamp”). Keep both digital and physical copies for safety.

- Course Syllabi: These provide evidence of the curriculum and the educational nature of the program. They demonstrate that the expenses were incurred for legitimate educational purposes.

- Enrollment Agreement or Contract: This document Artikels the terms of your enrollment, including the total cost of the program, payment schedule, and any other relevant details.

- Bank Statements or Credit Card Statements: These statements provide further evidence of your payments, corroborating the information on your tuition receipts. They should clearly show the payments made to the bootcamp.

- Other Relevant Documentation: This might include travel receipts (if applicable), accommodation receipts (if applicable), and any other documentation that substantiates expenses directly related to your bootcamp attendance.

Sample Record-Keeping System

A well-organized system for tracking your bootcamp expenses is key to a smooth tax filing process. This system should allow for easy access to all necessary documents when filing your taxes. A disorganized system can lead to stress and potential errors.

- Dedicated Folder: Create a physical or digital folder specifically for your coding bootcamp tax documents. Clearly label it and keep it organized.

- Spreadsheet Tracking: Use a spreadsheet to track all expenses. Include columns for date, description of expense, amount paid, payment method, and the receipt or document number. This provides a clear overview of your total expenses.

- Cloud Storage: Utilize cloud storage services (like Google Drive, Dropbox, or OneDrive) to create backups of your documents. This protects against loss or damage to your physical files.

- Regular Updates: Update your spreadsheet and folder regularly, adding new receipts and documents as you receive them. This prevents the accumulation of disorganized paperwork at the end of the year.

- Document Numbering: Assign a unique number to each document for easy referencing in your spreadsheet and during tax preparation.

Impact of Employment Status

The tax deductibility of coding bootcamp tuition hinges significantly on your employment status. Whether you’re employed by a company or self-employed as a freelancer or independent contractor directly impacts how you can claim the deduction and the ultimate tax benefit you receive. Understanding these differences is crucial for maximizing your tax savings.

The primary difference lies in *how* the deduction is claimed. Employed individuals generally utilize deductions within the context of their W-2 income, while self-employed individuals handle deductions differently through their business expenses on Schedule C (Form 1040). This distinction influences the documentation required and the overall impact on taxable income.

Deduction Claiming Methods for Employed Individuals

For employed individuals, the deductibility of coding bootcamp tuition often depends on whether the course enhances your current job skills or is necessary to maintain your current position. If the course directly relates to your current job duties, and your employer doesn’t reimburse you, you might be able to claim it as a miscellaneous itemized deduction. However, it’s important to note that miscellaneous itemized deductions are subject to a 2% AGI (Adjusted Gross Income) limitation. This means only the amount exceeding 2% of your AGI is deductible. For example, if your AGI is $60,000 and your bootcamp tuition was $10,000, only $8,000 ($10,000 – ($60,000 * 0.02)) would be considered for deduction. This deduction would then be further limited by your overall itemized deductions.

Deduction Claiming Methods for Self-Employed Individuals, Are coding bootcamp tuitions tax deductible

Self-employed individuals generally have a more straightforward path to deducting coding bootcamp tuition. Since the tuition is directly related to improving their business skills and increasing their earning potential, it’s usually considered an ordinary and necessary business expense. This means it can be deducted directly on Schedule C, reducing their net business profit and, consequently, their taxable income. For instance, a self-employed web developer attending a bootcamp to learn a new framework could fully deduct the tuition cost. The deduction directly lowers their self-employment tax liability as well as their income tax liability.

Impact on Taxable Income

The impact on taxable income differs significantly. For employed individuals, the deduction (if allowed) reduces their taxable income only after accounting for the 2% AGI limitation and potentially other itemized deductions. The benefit is often less significant compared to the deduction for self-employed individuals. Self-employed individuals, on the other hand, see a more direct reduction in their taxable income, potentially leading to substantial tax savings. The tuition deduction directly lowers their net earnings, affecting both income tax and self-employment tax. The precise amount of tax savings depends on individual tax brackets and other factors.

State Tax Implications: Are Coding Bootcamp Tuitions Tax Deductible

While federal tax laws offer some avenues for deducting educational expenses, the landscape shifts considerably at the state level. State tax codes vary widely, impacting whether you can claim deductions or credits for coding bootcamp tuition. Some states offer generous incentives for pursuing education and workforce development, while others provide no such benefits. Understanding your state’s specific tax laws is crucial for maximizing potential tax savings.

State tax laws regarding educational expenses are often complex and subject to change. It’s essential to consult your state’s tax agency website or a qualified tax professional for the most up-to-date and accurate information. Generally, deductions or credits are often tied to specific criteria, such as the type of program, the student’s residency status, and the amount of expenses incurred. Furthermore, income limits may apply, limiting the eligibility of higher-income earners.

State-Specific Tax Policies on Educational Expenses

Several states have implemented tax benefits related to educational expenses. These benefits can significantly reduce the overall cost of a coding bootcamp. However, the specifics of these programs differ widely. Some states offer direct deductions from taxable income, while others provide tax credits that directly reduce the amount of tax owed. Eligibility criteria, such as income limits and program accreditation, also vary.

| State | Tax Benefit Type | Eligibility Requirements (Summary) | Example |

|---|---|---|---|

| California | Tuition deduction (potentially applicable depending on specific circumstances and program type; check current California Franchise Tax Board guidelines) | May include requirements related to program length, accreditation, and student residency. | A California resident enrolled in a qualifying coding bootcamp might be able to deduct a portion of their tuition from their state taxable income. |

| Oregon | Oregon offers a variety of educational credits, some of which *might* apply to coding bootcamp tuition depending on the program’s accreditation and the student’s circumstances. Directly consulting the Oregon Department of Revenue is advised. | Specific requirements vary greatly depending on the credit claimed. | An individual completing a qualifying program could potentially reduce their state tax liability. |

| New York | New York’s tax laws do not generally offer specific deductions or credits for coding bootcamp tuition. Consult the New York State Department of Taxation and Finance for the most up-to-date information. | Generally, no state-level deductions are specifically designed for coding bootcamp tuition. | Unlike some states, New York does not currently offer a state-level tax benefit directly applicable to coding bootcamp tuition. |

| Washington | Washington’s tax code does not currently offer specific deductions or credits for coding bootcamp tuition. Consult the Washington State Department of Revenue for the most up-to-date information. | Generally, no state-level deductions are specifically designed for coding bootcamp tuition. | Similar to New York, Washington does not currently provide a state tax benefit specifically for coding bootcamp tuition. |

Alternative Funding Options and Tax Implications

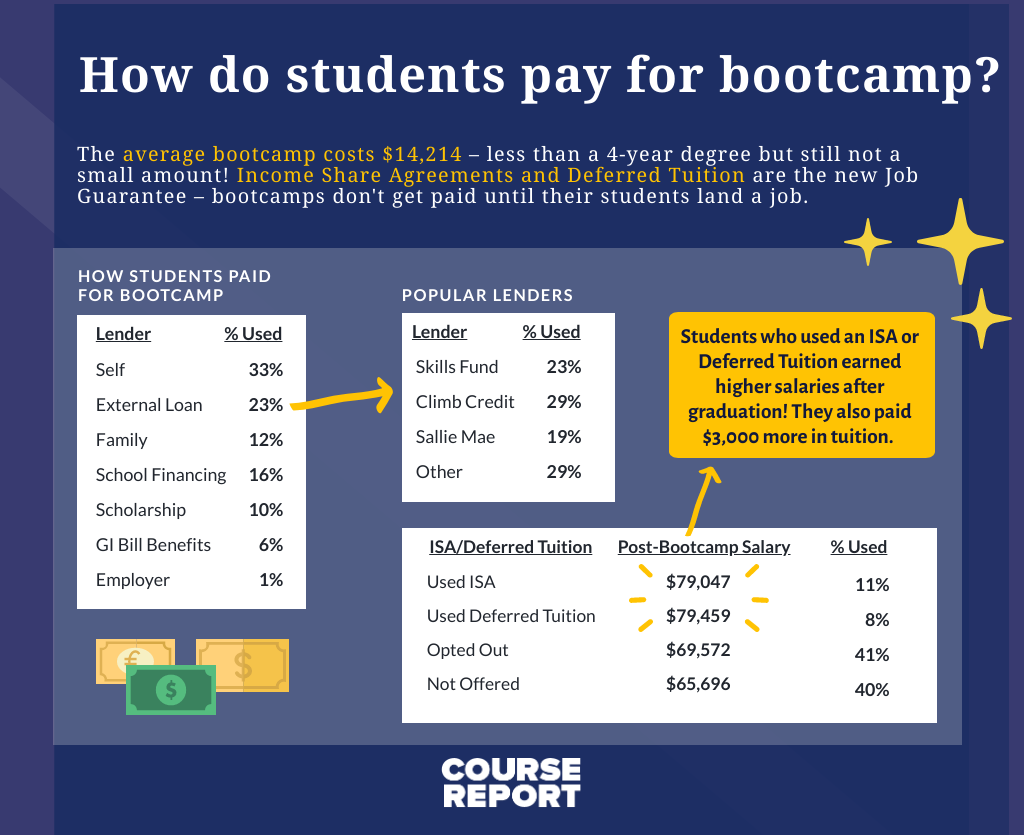

Funding a coding bootcamp can be a significant investment, and understanding the tax implications of different funding sources is crucial for effective financial planning. The tax treatment of your bootcamp expenses varies depending on how you finance them, impacting your overall tax liability. This section explores the tax implications of common funding methods, helping you make informed decisions.

Loans for Bootcamp Tuition

Student loans, whether federal or private, are generally not tax deductible in themselves. The interest paid on federal student loans *may* be deductible, depending on your modified adjusted gross income (MAGI) and other factors. However, the tuition itself is not deductible. For example, if you take out a $10,000 private loan for your bootcamp and pay $500 in interest during the year, only the interest payment might be considered for a potential deduction, subject to income limitations. The $10,000 principal is not tax deductible. Consult the IRS Publication 970 for detailed information on student loan interest deductions.

Scholarships and Grants

Scholarships and grants awarded for educational purposes are generally not considered taxable income. This means you won’t have to pay taxes on the money received. For instance, if you receive a $5,000 scholarship to cover your bootcamp tuition, you don’t need to report this as income. This is a significant advantage compared to loans.

Employer-Sponsored Tuition Reimbursement

If your employer offers a tuition reimbursement program, the amount reimbursed is generally not considered taxable income, provided you meet certain conditions set by the employer and the IRS. For example, if your employer reimburses $8,000 of your $10,000 bootcamp cost, you would likely not be taxed on the $8,000. However, if you receive a reimbursement exceeding the actual costs, the excess amount might be considered taxable income. Always check with your employer’s HR department and consult a tax professional for specific guidance.

Personal Savings and Investments

Using personal savings or investment accounts to pay for your bootcamp doesn’t have direct tax implications regarding the tuition itself. However, you should be aware of the tax implications of any gains or losses you might experience from selling investments to fund the bootcamp. For example, if you sell stocks at a profit to pay for the bootcamp, you will owe capital gains tax on the profit. Conversely, if you sell at a loss, you may be able to deduct that loss on your taxes, subject to IRS limitations. Careful financial planning is essential here.

Consultations with Tax Professionals

Navigating the complexities of tax deductions for educational expenses, such as coding bootcamp tuition, can be challenging. While the information provided previously offers a solid foundation, seeking professional tax advice significantly enhances your understanding and minimizes the risk of errors. A qualified tax professional possesses the expertise to interpret the nuances of tax laws and apply them specifically to your individual circumstances.

The benefits of consulting a tax professional extend beyond simply determining deductibility. They can help you optimize your tax strategy, ensuring you claim all eligible deductions and credits, and ultimately reducing your overall tax liability. They can also provide guidance on proper documentation and record-keeping, ensuring compliance with IRS regulations and protecting you from potential audits.

Situations Requiring Professional Tax Advice

Professional guidance is particularly valuable in several scenarios. These scenarios often involve complexities beyond the scope of general guidelines.

For example, individuals with complex financial situations, such as self-employment income, multiple sources of income, or significant deductions beyond coding bootcamp tuition, will greatly benefit from expert assistance. A tax professional can help navigate the interplay of various deductions and credits to maximize tax savings. Similarly, individuals facing specific circumstances like significant changes in employment status during the bootcamp or those who are unsure about the classification of their bootcamp expenses (e.g., is it a qualified education expense, or is it considered job training?) should definitely consult a tax professional. They can clarify the applicable regulations and help you make informed decisions. Finally, those who are unsure about how state taxes interact with federal tax deductions for educational expenses should seek professional help to ensure compliance with all applicable regulations.

Tim Redaksi