Deductibility of Coding Bootcamp Expenses

Determining whether coding bootcamp expenses are tax deductible depends on several factors and isn’t a straightforward yes or no answer. The Internal Revenue Service (IRS) has specific guidelines regarding the deductibility of education expenses, and understanding these rules is crucial for accurately claiming deductions. This section will clarify the rules and provide examples to illustrate the complexities involved.

IRS Guidelines for Education Expense Deductibility

The IRS generally allows deductions for educational expenses only if the education maintains or improves skills required in your current job. It does *not* allow deductions for education that qualifies you for a new job or a new career field. This distinction is key to determining the deductibility of coding bootcamp costs. If the bootcamp enhances skills directly applicable to your existing role as a programmer, for instance, then some expenses might be deductible. However, if the bootcamp prepares you for a completely new career path (e.g., transitioning from a marketing role to a software engineering role), the expenses are likely non-deductible. The IRS scrutinizes the relationship between the education and the taxpayer’s existing work.

Examples of Deductible and Non-Deductible Education Expenses

Several factors influence whether an expense is deductible. The primary determinant is whether the course directly relates to your current work. For example, a software engineer attending a bootcamp focusing on advanced JavaScript frameworks relevant to their current projects might find some expenses deductible. Conversely, a graphic designer enrolling in a full-stack web development bootcamp to change careers would likely find their expenses non-deductible.

Comparison of Deductible and Non-Deductible Expenses

The following table illustrates typical expenses associated with coding bootcamps and categorizes them based on potential deductibility. Remember, this is a general guideline, and individual circumstances will determine the final IRS ruling. Always consult a tax professional for personalized advice.

| Course Fees | Books | Software | Travel |

|---|---|---|---|

| Potentially Deductible (if job-related) | Potentially Deductible (if directly related to current job) | Potentially Deductible (if used for current job) | Generally Non-Deductible (unless required for a specific job-related course) |

| Example: Advanced JavaScript Framework Course for a current software engineer. | Example: Textbook on improving database management skills for a current database administrator. | Example: Specialized software licenses needed for a current project. | Example: Travel to a coding bootcamp unrelated to current employment. |

Coding Bootcamps as Job-Related Education

Coding bootcamps, while offering intensive training in programming and related skills, don’t automatically qualify for tax deductions. The Internal Revenue Service (IRS) carefully scrutinizes educational expenses, focusing on whether the courses directly relate to your current job or are necessary for maintaining your current employment. This determination hinges on several factors, which we will explore in detail.

The deductibility of coding bootcamp expenses as job-related education depends on whether the course enhances your existing skills for your current employment or is required by your employer. It is not deductible if the bootcamp prepares you for a new career field entirely unrelated to your current occupation. The IRS guidelines emphasize the direct relationship between the education and the taxpayer’s current job.

Requirements for Claiming a Deduction for Job-Related Education

To claim a deduction, the education must meet specific IRS criteria. The expenses must be for courses that maintain or improve skills required in your current job. The education cannot be used to meet the minimum educational requirements for your current position, or to qualify you for a new position. Furthermore, the education must be undertaken to maintain or improve your skills in your present work, not to acquire new skills for a different job. Finally, the expenses must be substantiated with proper documentation, such as receipts and invoices from the bootcamp.

Examples of Qualifying and Non-Qualifying Situations

Several scenarios illustrate the distinction between deductible and non-deductible coding bootcamp expenses.

Is coding bootcamp tax deductible – Qualifying Examples:

- A software engineer enrolled in a bootcamp to learn a new programming language (e.g., Python) directly relevant to their current projects and required by their employer.

- A web developer taking a bootcamp focused on improving their skills in user interface/user experience (UI/UX) design, a crucial aspect of their current role.

- A data analyst completing a bootcamp specializing in advanced data visualization techniques, directly applicable to their current responsibilities and improving their efficiency.

Non-Qualifying Examples:

- A marketing professional enrolling in a coding bootcamp to transition to a software engineering career, with no current relevance to their marketing job.

- A teacher attending a coding bootcamp to prepare for a completely unrelated career in software development after retirement.

- An individual enrolling in a coding bootcamp to meet the minimum educational requirements for a new job application in a completely different field.

Flowchart for Determining Deductibility

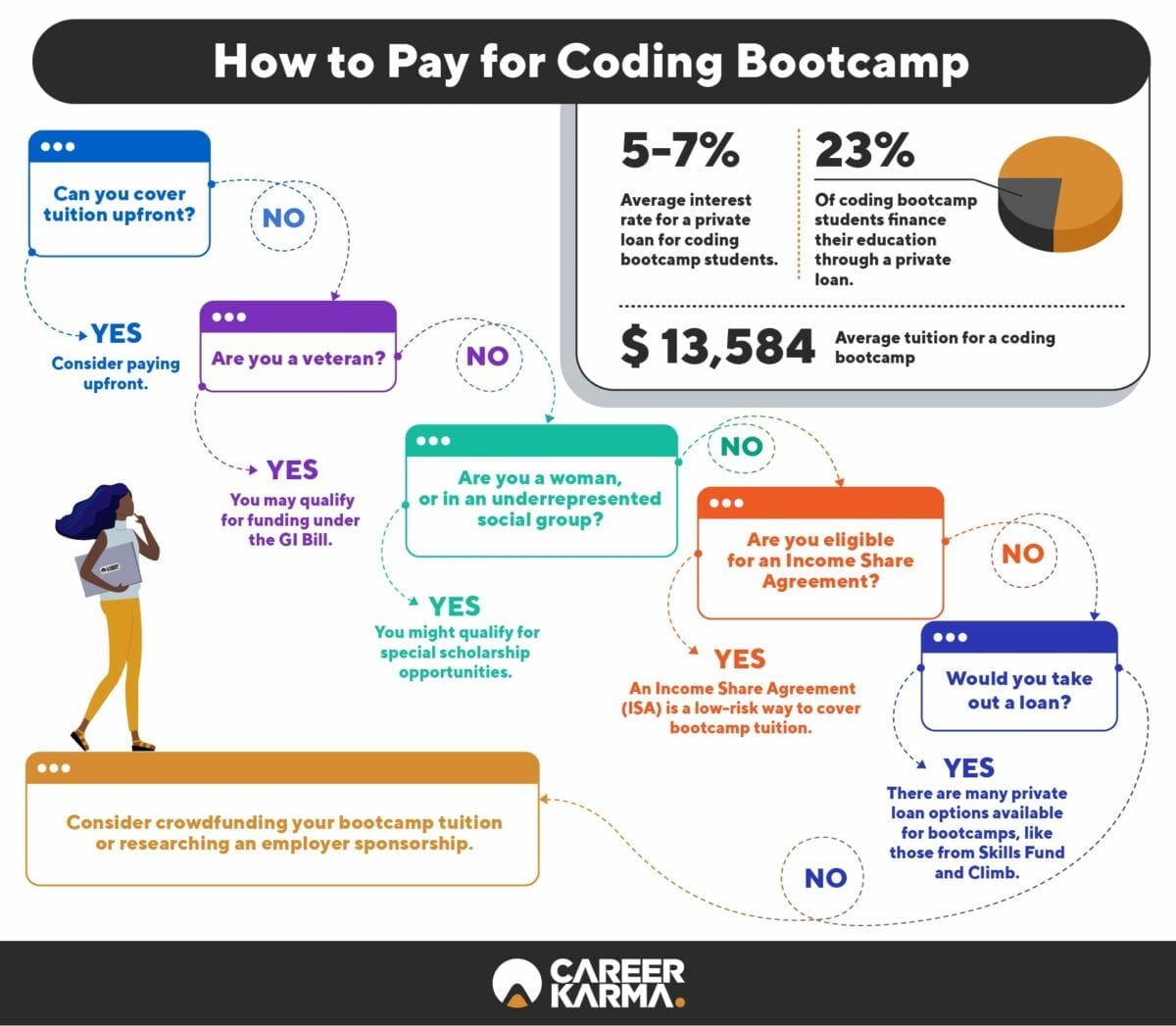

The following flowchart visually represents the decision-making process for determining the deductibility of coding bootcamp expenses:

[Flowchart Description]: The flowchart would begin with a starting point: “Did you attend a coding bootcamp?”. A “Yes” branch leads to the question: “Is the bootcamp directly related to maintaining or improving skills required in your current job?”. A “Yes” response leads to: “Are the skills learned required by your current employer or enhance your current job performance?”. A “Yes” answer results in: “Expenses may be deductible. Consult IRS Publication 970 for detailed guidelines.” A “No” response at either of these points leads to: “Expenses are likely not deductible.” A “No” response to the initial question ends the flowchart.

Impact of Employment Status on Deductibility

The deductibility of coding bootcamp expenses hinges significantly on your employment status. Whether you’re employed or self-employed impacts which tax forms you’ll use, the documentation you need to provide, and even the likelihood of successfully claiming the deduction. Understanding these differences is crucial for maximizing your tax benefits.

The primary distinction lies in how the IRS views the expenses: as a job-related expense for an employed individual or as a business expense for a self-employed individual. This difference affects the specific tax forms and the level of substantiation required.

Deductibility for Employed Individuals

For employed individuals, coding bootcamp expenses might be deductible as a job-related education expense under certain conditions. These conditions include demonstrating that the education maintains or improves skills required in your current job. Simply seeking a new job or career change usually disqualifies the expense. The expense must also be for courses directly related to your existing job duties, not for a completely unrelated field.

Deductibility for Self-Employed Individuals

Self-employed individuals can potentially deduct coding bootcamp expenses as business expenses. This is generally easier to substantiate than for employed individuals, as the connection between the education and the business is more direct. However, the expenses must still be ordinary and necessary for the business. This means the courses must be relevant to the skills needed for your self-employed work.

Relevant Tax Forms and Schedules

The tax forms used differ depending on employment status.

- Employed Individuals: Form 1040, Schedule A (Itemized Deductions). You’ll need to itemize deductions and meet the requirements for deducting education expenses. This is often a more stringent process. It’s important to note that the deduction might be limited or disallowed if the course leads to a new career.

- Self-Employed Individuals: Form 1040, Schedule C (Profit or Loss from Business). These expenses are reported as business expenses directly impacting your business profit. This typically makes it easier to claim the deduction if it meets the “ordinary and necessary” business expense criteria.

Documentation Needed to Support a Deduction

The type and amount of documentation needed also varies depending on your employment status.

- Employed Individuals: You will need documentation demonstrating that the course directly relates to your current job responsibilities. This might include a letter from your employer confirming the relevance of the training, course syllabi, and receipts for the bootcamp expenses. The stronger the connection between the course and your current job, the better chance you have of a successful deduction.

- Self-Employed Individuals: You’ll need receipts for the bootcamp expenses and documentation that shows how the bootcamp improved your business skills or generated income. This could include invoices, client testimonials, or a description of how the skills learned were applied in your work. The more detailed the documentation, the more easily you can demonstrate the direct connection between the bootcamp and your business.

Differences in Claiming the Deduction

To summarize, here’s a bulleted list highlighting the key differences:

- Tax Form: Employed individuals use Schedule A; self-employed individuals use Schedule C.

- Deduction Type: Employed individuals claim job-related education expenses; self-employed individuals claim business expenses.

- Requirements: Employed individuals must show the course maintains or improves current job skills; self-employed individuals must show the course is ordinary and necessary for their business.

- Documentation: Employed individuals need employer verification and course syllabi; self-employed individuals need receipts and evidence of business application of the skills learned.

Tax Credits and Other Relevant Deductions: Is Coding Bootcamp Tax Deductible

Coding bootcamp expenses might qualify for certain tax benefits beyond the standard deduction for educational expenses. These benefits can significantly reduce your tax liability, making the investment in your career development more financially manageable. Understanding these potential deductions and credits is crucial for maximizing your tax savings.

American Opportunity Tax Credit (AOTC)

The American Opportunity Tax Credit is a potentially valuable credit for students pursuing higher education, including those attending coding bootcamps that meet specific criteria. It offers a maximum credit of $2,500 per student per year for the first four years of higher education. To qualify, the student must be pursuing a degree or other credential at an eligible educational institution, be enrolled at least half-time, and not have completed the first four years of higher education. Furthermore, the student must not have a felony drug conviction. The credit is phased out for higher income taxpayers. For example, a student who pays $10,000 in qualified education expenses and meets all other requirements could reduce their tax liability by $2,500, effectively lowering the cost of the bootcamp.

Lifetime Learning Credit (LLC)

The Lifetime Learning Credit is another potential tax credit that could apply to coding bootcamp expenses. Unlike the AOTC, the LLC is not limited to the first four years of higher education. It offers a maximum credit of $2,000 per tax return, regardless of the number of students. However, the credit is nonrefundable, meaning it can reduce your tax liability to zero but you won’t receive any of the credit back as a refund. This credit applies to courses taken to obtain a degree or to acquire job skills, making it potentially applicable to many coding bootcamps. For instance, a taxpayer with $10,000 in qualified expenses might reduce their tax bill by $2,000.

Deduction for Qualified Education Expenses

Taxpayers can also deduct qualified education expenses, including coding bootcamp tuition, fees, and books, as an above-the-line deduction. This deduction is an adjustment to gross income, meaning it reduces your adjusted gross income (AGI) before calculating your taxable income. The amount of the deduction is limited, and it might be more beneficial to claim the AOTC or LLC depending on your specific circumstances and income. The deduction can be valuable, however, especially for those who don’t qualify for the credits. For example, a taxpayer who incurs $5,000 in qualified education expenses can deduct this amount, potentially reducing their taxable income and their overall tax liability.

Comparison of Potential Tax Benefits

| Tax Benefit | Maximum Credit/Deduction | Requirements | Example Savings |

|---|---|---|---|

| American Opportunity Tax Credit (AOTC) | $2,500 per student, per year (first four years) | Half-time enrollment, degree pursuit, no felony drug conviction | $2,500 reduction in tax liability |

| Lifetime Learning Credit (LLC) | $2,000 per tax return | Course taken to obtain a degree or acquire job skills | $2,000 reduction in tax liability |

| Deduction for Qualified Education Expenses | Varies, subject to limitations | Expenses must be for qualified education | Varies depending on the amount of qualified expenses and the taxpayer’s tax bracket |

| No Tax Benefit | $0 | Expenses don’t meet the requirements for any education tax benefits | $0 reduction in tax liability |

Documentation and Record-Keeping

Meticulous record-keeping is crucial for successfully claiming a tax deduction for coding bootcamp expenses. The IRS requires substantial evidence to support any deduction, and a well-organized collection of documents will significantly strengthen your claim and avoid potential complications during an audit. Failing to maintain adequate records can result in the rejection of your deduction claim.

Proper documentation ensures you can accurately demonstrate the educational nature of the expenses and their direct relationship to your employment or career advancement. This includes not only the total cost but also a breakdown of individual expenses, allowing for a clear and transparent accounting of your investment in your professional development.

Types of Acceptable Documentation, Is coding bootcamp tax deductible

Supporting your coding bootcamp deduction requires retaining a variety of documentation. These documents serve as irrefutable proof of your expenses and the legitimacy of your claim. The more comprehensive your records, the stronger your case will be.

- Receipts: Keep all receipts for tuition fees, books, software, and any other materials purchased directly from the bootcamp. These should clearly indicate the date of purchase, the vendor’s name, and the amount paid. Digital receipts are acceptable, provided they are clearly legible and readily accessible.

- Invoices: If you paid for your bootcamp through an invoice, retain a copy of the invoice as proof of payment. The invoice should contain the same key information as receipts: date, vendor, and amount.

- Course Enrollment Confirmation: This document confirms your enrollment in the bootcamp and should include the course name, dates of attendance, and total cost. A copy of your acceptance letter or email correspondence confirming your enrollment can also be useful.

- Loan Documents (if applicable): If you financed your bootcamp through a loan, keep records of the loan agreement, payment schedules, and any interest paid. This documentation supports the educational expense deduction and any potential interest deductions.

Organizing Financial Records

Effective organization is key to simplifying the tax preparation process and ensuring you have all the necessary documents readily available when filing your taxes. A systematic approach minimizes the risk of missing crucial information.

- Dedicated Folder: Create a dedicated folder (physical or digital) specifically for all your coding bootcamp expenses. This keeps everything organized and easily accessible.

- Chronological Ordering: Arrange your documents chronologically, by date of purchase or transaction. This makes it simple to track expenses over time and identify any potential discrepancies.

- Categorization: Categorize your expenses (e.g., tuition, books, software). This will help you easily identify the different components of your overall bootcamp costs when preparing your tax return.

- Spreadsheet Tracking: Use a spreadsheet to summarize all your expenses. Include columns for the date, description of the expense, vendor, and amount paid. This provides a clear overview of your total spending and simplifies the process of transferring the information to your tax return.

Tim Redaksi