Eligibility Criteria for Financial Aid

Securing financial aid for a coding bootcamp often involves meeting specific criteria set by the bootcamp itself or the financing institution providing the aid. These criteria vary, but generally revolve around demonstrating financial need and commitment to completing the program. Understanding these requirements is crucial for a successful application.

Eligibility for financial aid for coding bootcamps is a multi-faceted process. Several key factors are considered, and meeting all requirements doesn’t guarantee approval, but significantly improves the chances.

Credit History

A good credit history is not always a strict requirement, but it can significantly influence the approval process, particularly for loans. Lenders often check credit scores to assess the risk of default. A higher credit score typically translates to more favorable loan terms, including lower interest rates. Individuals with limited or poor credit history might find it more challenging to secure financing or might be offered loans with higher interest rates. Some bootcamps may offer financing options that don’t require a credit check, but these options may have more stringent eligibility requirements in other areas.

Income Level

Income level plays a significant role in determining eligibility for need-based financial aid. Bootcamps and lenders often use income verification documents to assess financial need. Lower income levels generally increase the likelihood of approval for grants or subsidized loans. Applicants are usually required to provide documentation like tax returns or pay stubs to support their income claims. The specific income thresholds vary widely depending on the institution and the type of aid offered. For example, a bootcamp might offer need-based scholarships to individuals earning below a certain annual income.

Academic Background

While a formal academic background isn’t always mandatory for coding bootcamp admission, it can influence financial aid eligibility indirectly. Some scholarships or grants might prioritize applicants with a demonstrable commitment to education, even if that’s not a traditional college degree. For instance, a strong academic record from previous educational pursuits might strengthen an application for merit-based financial aid. However, many bootcamps specifically cater to individuals without formal degrees, and lack of a traditional academic background is not an automatic barrier to financial aid.

Age, Employment Status, and Prior Educational Experience

Age, employment status, and prior educational experience can indirectly influence eligibility. Some programs might offer specific scholarships or grants targeted towards certain age groups, such as veterans or career changers. Employment status can also impact eligibility, with some programs prioritizing unemployed or underemployed individuals. Prior educational experience, even if not a degree, can demonstrate commitment and may be viewed favorably. These factors often influence the overall assessment of financial need and potential for success in the program. For example, a veteran transitioning from military service might be eligible for specific veteran’s aid programs offered by the bootcamp or external organizations.

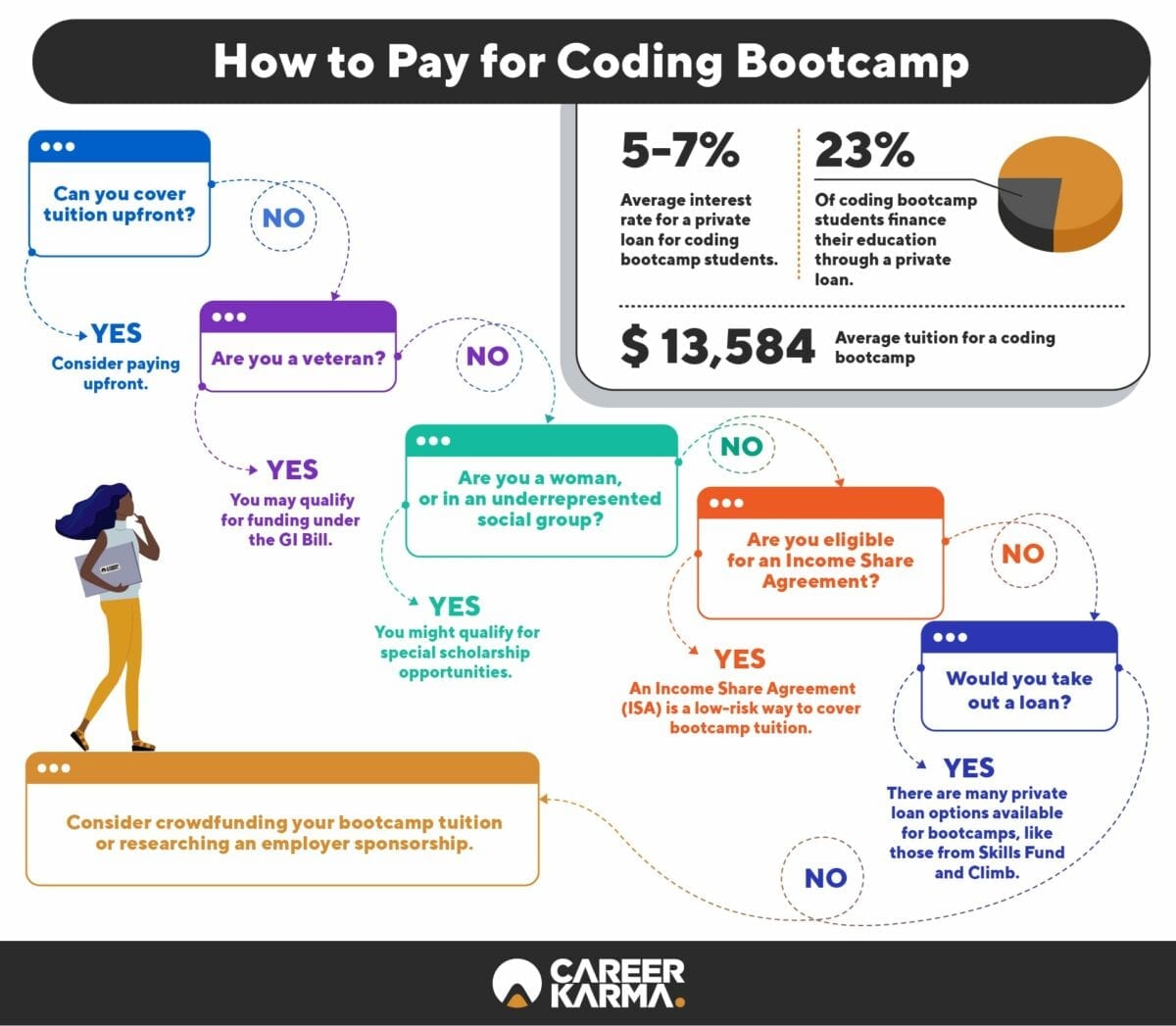

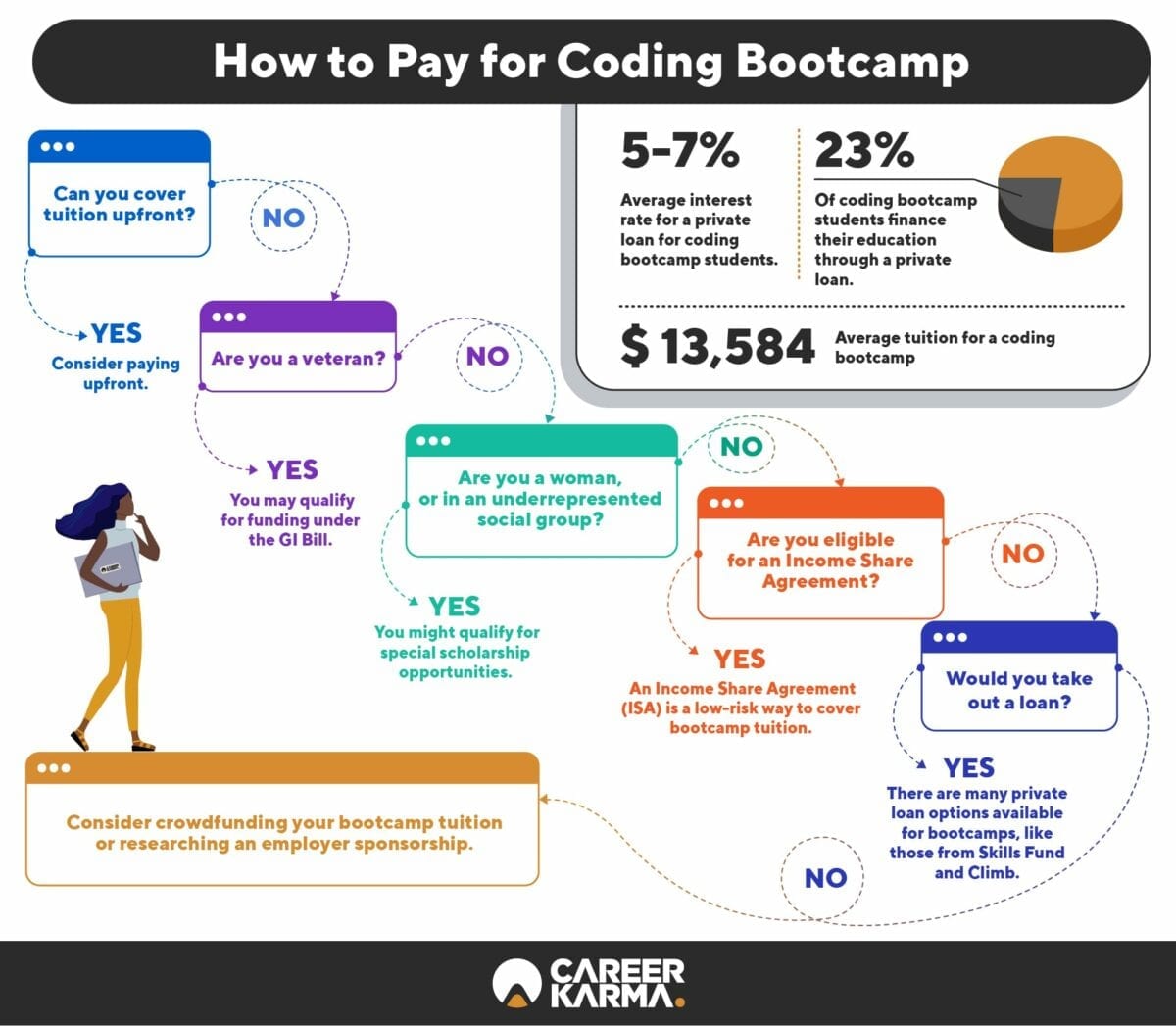

Flowchart Illustrating the Decision-Making Process for Determining Financial Aid Eligibility

The following flowchart depicts a simplified representation of the decision-making process. It is important to note that the actual process can vary significantly depending on the specific bootcamp and lender.

[Imagine a flowchart here. The flowchart would start with “Apply for Financial Aid”. This would branch into two paths: “Meet Minimum Requirements?” Yes would lead to “Credit Check/Income Verification”. This would branch into two paths: “Pass Credit/Income Check?” Yes would lead to “Financial Aid Approved”. No would lead to “Financial Aid Denied”. No from the initial “Meet Minimum Requirements?” would lead directly to “Financial Aid Denied”. Each box in the flowchart would be clearly labeled.]

Applying for Financial Aid

Securing financial aid for a coding bootcamp can significantly reduce the upfront cost of your education and help you launch your tech career sooner. The application process, while potentially daunting, is manageable with careful planning and attention to detail. Understanding the steps involved and common pitfalls will greatly increase your chances of success.

The application process typically involves several key steps, each requiring careful attention and accurate information. Failing to complete any step thoroughly can lead to delays or even rejection of your application. Remember, the goal is to present a clear and accurate picture of your financial situation to the bootcamp’s financial aid provider.

Application Completion

Completing the financial aid application accurately is paramount. Bootcamps use this information to assess your eligibility and determine the amount of aid you may receive. Applications often require detailed personal and financial information, including income details, assets, and debts. Inaccurate or incomplete information will likely delay the processing of your application and could result in its rejection. Take your time to carefully review each section of the application before submitting it. Many bootcamps offer online applications, making the process more streamlined and efficient. However, it’s crucial to double-check all entered data for accuracy.

Gathering Necessary Documentation

Most bootcamps require supporting documentation to verify the information provided in your application. Common documents include tax returns, pay stubs, bank statements, and proof of any existing student loans. Gather these documents well in advance of the application deadline to avoid last-minute rushes. Organize your documents systematically to ensure you can quickly locate the required information when needed. Keep copies of all submitted documents for your records. Failure to provide the necessary documentation can lead to significant delays or rejection of your financial aid application.

Meeting Deadlines

Adhering to deadlines is critical. Bootcamps often have strict deadlines for submitting financial aid applications. Missing these deadlines can result in the loss of your eligibility for financial aid. Mark the application deadline prominently on your calendar and set reminders to ensure you submit your application on time. Plan your document gathering and application completion well in advance of the deadline to avoid any last-minute issues. Remember, proactive planning is key to a successful application.

Common Application Mistakes

Several common mistakes can hinder the financial aid application process. One frequent error is providing inaccurate or incomplete financial information. This can lead to delays, rejections, or a reduced amount of aid offered. Another common mistake is failing to submit all required documentation. This often delays the processing of the application, potentially causing you to miss the start date of the bootcamp. Finally, missing the application deadline is a significant issue that can lead to ineligibility for financial aid. For example, a student might incorrectly report their income, leading to a recalculation of their eligibility and a reduction in the amount of aid they receive. Another example is a student forgetting to submit a tax return, delaying their application and potentially missing the bootcamp start date. Careful attention to detail and thorough planning can help avoid these pitfalls.

Understanding Loan Options

Securing funding for a coding bootcamp often involves exploring various loan options. Understanding the differences between these options is crucial for making an informed financial decision that aligns with your individual circumstances and risk tolerance. Each loan type carries its own set of advantages and disadvantages regarding interest rates, repayment terms, and potential long-term financial implications.

Choosing the right loan can significantly impact your post-bootcamp financial health. Careful consideration of interest rates, repayment schedules, and potential risks is essential to avoid overwhelming debt.

Federal Student Loans

Federal student loans are government-backed loans offered through programs like the Direct Loan program. These loans typically offer lower interest rates compared to private loans and often come with more flexible repayment options, including income-driven repayment plans that adjust your monthly payments based on your income. However, eligibility is based on factors like credit history and financial need, and the loan amounts may be limited. For example, the maximum amount you can borrow under the Direct Unsubsidized Loan program depends on your year of study (freshman, sophomore, etc.) and whether you are considered a dependent or independent student.

Private Loans

Private loans are offered by banks and other financial institutions. These loans often have higher interest rates than federal loans and may require a creditworthy co-signer, especially for students with limited or no credit history. Repayment terms can vary widely depending on the lender, but they generally lack the flexible repayment options available with federal loans. For instance, a private loan might have a fixed interest rate of 8% over a 5-year repayment period, whereas a federal loan might offer a lower rate and the option to extend the repayment term.

Income Share Agreements (ISAs)

Income Share Agreements are a relatively newer alternative to traditional loans. With an ISA, you don’t borrow money upfront; instead, you agree to pay a percentage of your income after you graduate and secure a job above a certain salary threshold. The percentage and repayment period are predetermined in the agreement. While ISAs can be attractive because you only pay back if you’re employed and earning a sufficient income, the total amount you end up paying can potentially exceed the cost of the bootcamp, especially if your income significantly surpasses the threshold. The length of repayment is also often longer than traditional loan terms. For example, an ISA might require a 15% share of your income for three years, post-graduation, only if your annual salary exceeds $50,000.

Comparison of Federal and Private Loans

- Interest Rates: Federal loans generally have lower interest rates than private loans.

- Repayment Terms: Federal loans often offer more flexible repayment options, including income-driven repayment plans. Private loans typically have less flexible repayment terms.

- Eligibility Requirements: Federal loans may have less stringent eligibility requirements than private loans, which often require a good credit history or a co-signer.

- Loan Amounts: Federal loan amounts may be capped, while private loans may offer larger loan amounts.

- Default Consequences: Defaulting on a federal loan can have serious consequences, such as damage to your credit score and potential wage garnishment. Defaulting on a private loan can also negatively impact your credit score but may not involve the same government-backed enforcement mechanisms.

Scholarships and Grants for Coding Bootcamps

Securing funding for a coding bootcamp can significantly reduce the financial burden and make this career-enhancing opportunity more accessible. While loans are a common option, scholarships and grants offer a valuable alternative, allowing students to pursue their education without accumulating debt. Numerous organizations and institutions provide financial assistance specifically for bootcamp attendees, based on merit, need, or specific demographics.

Can you get financial aid for coding bootcamp – Many scholarships and grants are competitive, requiring a strong application showcasing your skills, experience, and commitment to the field. Successful applications often highlight a clear career path, demonstrate financial need (where applicable), and present a compelling narrative explaining your motivation for pursuing a coding bootcamp.

Organizations Offering Scholarships and Grants

Several organizations offer scholarships and grants specifically designed for aspiring coders. These opportunities often target underrepresented groups or individuals with specific backgrounds. Researching these organizations and their eligibility criteria is crucial for maximizing your chances of securing funding.

- The Skillcrush Scholarship: This scholarship is specifically for women and non-binary individuals interested in tech careers. It focuses on supporting individuals from underrepresented backgrounds in the tech industry.

- Codecademy Scholarships: Codecademy, a well-known online learning platform, occasionally offers scholarships for its courses, some of which can be applied towards bootcamp prep or even full bootcamp tuition. Eligibility criteria vary.

- Google Scholarships: Google offers various scholarships, some focusing on computer science and technology-related fields. These scholarships are highly competitive and usually target students pursuing degrees, but some might be applicable to bootcamp attendees depending on the specific program.

- Individual Bootcamp Scholarships: Many coding bootcamps offer their own scholarships based on merit, financial need, or affiliation with specific organizations. Check directly with the bootcamp you are interested in attending.

- Nonprofit Organizations: Numerous non-profit organizations focused on education and technology offer grants and scholarships. These opportunities often target specific demographics or focus on particular areas of technology.

Examples of Successful Scholarship Essays and Grant Applications

Successful scholarship and grant applications often share common characteristics. They are well-written, concise, and effectively communicate the applicant’s qualifications and need. They often include a compelling personal narrative and clearly articulate the applicant’s career goals and how the funding will help them achieve those goals.

While specific examples of successful applications are usually kept confidential due to privacy reasons, a common thread is the demonstration of a genuine passion for coding and a clear understanding of how the bootcamp will advance the applicant’s career prospects. The essay should highlight relevant skills and experiences, demonstrating a commitment to the field and a grasp of the challenges and opportunities it presents. The application should also convincingly articulate the applicant’s financial need, if applicable.

Effectively Researching and Applying for Scholarships and Grants

A systematic approach is essential for effectively researching and applying for scholarships and grants. This includes utilizing various resources and carefully tailoring each application to the specific requirements of the funding opportunity.

- Utilize Online Scholarship Databases: Websites like Scholarships.com, Fastweb, and Peterson’s offer extensive databases of scholarships and grants. These databases allow you to filter by criteria such as field of study, major, and financial need.

- Check with Your Bootcamp: Many coding bootcamps maintain a list of scholarships and grants available to their students. Contact the bootcamp’s financial aid office for information about internal and external funding opportunities.

- Network with Professionals: Networking with professionals in the tech industry can lead to discovering less publicized scholarship opportunities. Attend industry events, join online communities, and connect with mentors who might be aware of relevant funding sources.

- Tailor Your Application: Each scholarship or grant application has unique requirements. Carefully read the guidelines and tailor your application materials, including your essay or personal statement, to match the specific criteria and priorities of each opportunity. Generic applications are rarely successful.

- Proofread Carefully: Errors in grammar and spelling can significantly detract from your application. Thoroughly proofread all materials before submitting them.

Employer-Sponsored Training Programs: Can You Get Financial Aid For Coding Bootcamp

Many companies recognize the value of upskilling their workforce and offer training programs, sometimes including coding bootcamps, to enhance employee skills. This can be a significant advantage for aspiring developers, offering a pathway to a new career without the upfront financial burden of self-funding a bootcamp. However, it’s crucial to understand the nuances of these programs before relying on them as your sole funding source.

Exploring employer-sponsored training opportunities involves investigating your current employer’s policies, or researching companies known for robust employee development programs. This might involve reviewing employee handbooks, contacting HR departments, or networking with professionals in your desired field. Success in securing employer-sponsored training often depends on demonstrating a clear connection between the bootcamp and your current or future role within the company.

Benefits of Employer-Sponsored Training

Securing employer-sponsored training offers several key advantages. Employees often receive full or partial tuition reimbursement, significantly reducing or eliminating personal financial strain. Furthermore, the training is often tailored to the company’s needs, potentially leading to faster career advancement and increased earning potential within the organization. This structured learning path can also provide valuable mentorship and networking opportunities within the company. The commitment from the employer also signals confidence in the employee’s potential and dedication to their growth.

Drawbacks of Employer-Sponsored Training, Can you get financial aid for coding bootcamp

While employer-sponsored training offers substantial benefits, it also presents certain drawbacks. The primary concern is the potential loss of flexibility. The employer may dictate the specific bootcamp, curriculum, or even the timing of the training, limiting the employee’s choice and potentially compromising their preferred learning style or career goals. Additionally, there may be contractual obligations, such as a commitment to remain with the company for a specified period after completing the training. Failure to meet these obligations could result in repayment of the tuition assistance. Furthermore, the availability of such programs varies widely across industries and companies, making it less accessible to some individuals.

Scenario: Self-Funded vs. Employer-Funded Bootcamp

Consider two individuals, both aiming to become web developers. Sarah self-funds a 12-week bootcamp costing $15,000, incurring significant debt and foregoing income during the training period. She graduates with skills in high demand but carries a considerable financial burden. In contrast, Mark secures employer-sponsored training through his company’s upskilling initiative. His employer covers 80% of the tuition, reducing his out-of-pocket expense to $3,000. He also receives paid time off for the training, maintaining his income stream. Upon graduation, Mark benefits from both his new skills and the continued support of his employer, leading to a potentially smoother career transition. This scenario highlights the significant financial and logistical differences between the two approaches.

Tim Redaksi