Defining “Qualified Education Expenses” in Relation to Coding Bootcamps

The use of 529 plans to pay for coding bootcamps is a relatively new area, leading to some uncertainty about whether bootcamp tuition qualifies as a qualified education expense under IRS guidelines. This section clarifies the criteria and potential challenges involved.

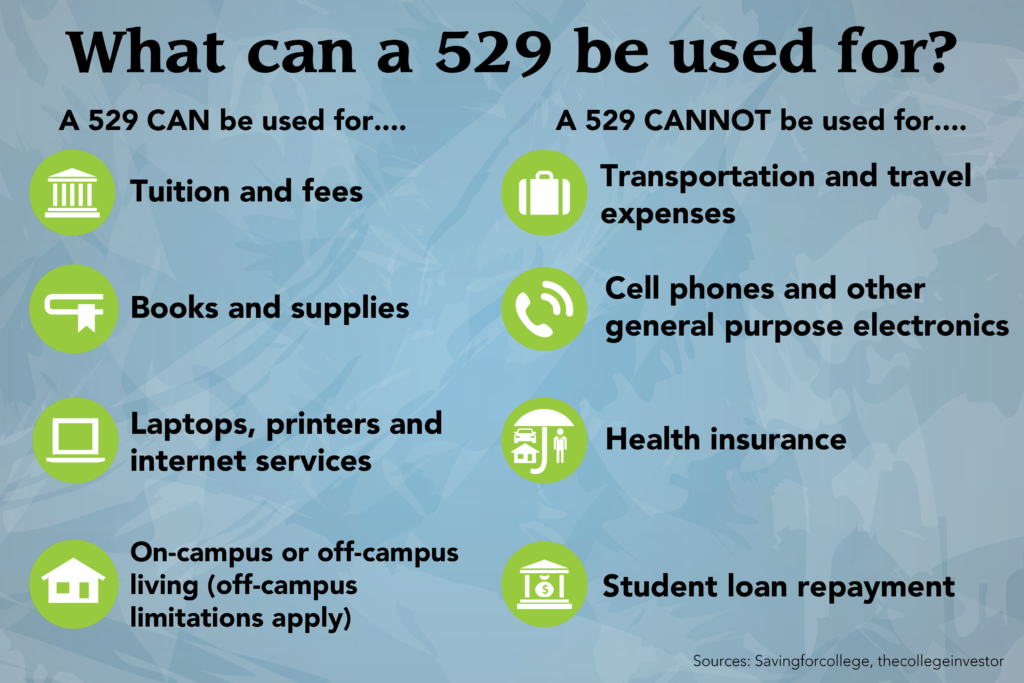

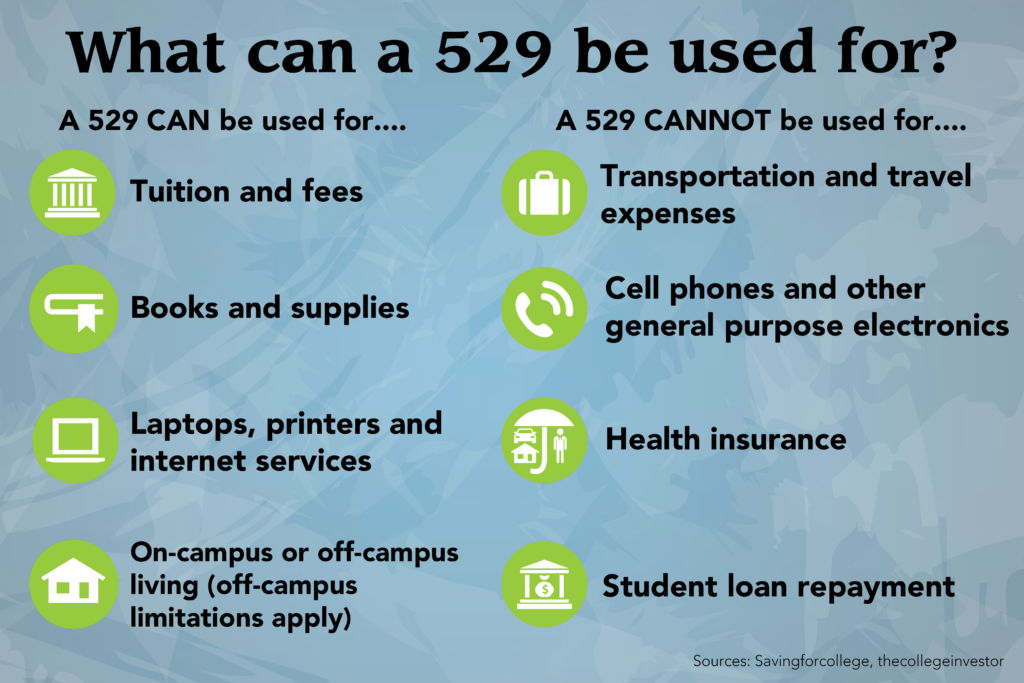

The IRS defines qualified education expenses as those paid for tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. Crucially, this definition doesn’t explicitly mention coding bootcamps, leading to the need for careful consideration of individual circumstances and program specifics.

Criteria for Qualifying Programs

Determining if a coding bootcamp meets the criteria for 529 plan funding hinges on demonstrating that the program provides education leading to a degree or other credential, and that the expenses are directly related to the curriculum. The IRS focuses on the educational nature of the program, not its format or location. Therefore, a program offered online or in-person can qualify, provided it meets the educational criteria. The length of the program is not a determining factor; a shorter, intensive bootcamp can qualify just as a longer, more traditional program can.

Challenges in Proving Qualification

A primary challenge lies in providing sufficient evidence to the IRS that the bootcamp is an eligible educational institution and that the expenses were for qualified education expenses. Unlike traditional colleges and universities, coding bootcamps may not have the same established accreditation or readily available documentation to support these claims. The lack of a formal degree may also raise questions about the educational nature of the program. Furthermore, some bootcamps may include expenses not considered qualified education expenses, such as career services or job placement assistance. Separating these expenses from tuition and other qualified costs is crucial for successful 529 plan reimbursement.

Supporting Documentation for 529 Plan Reimbursement

To successfully claim reimbursement for coding bootcamp costs using a 529 plan, individuals should gather comprehensive documentation. This might include:

- An official acceptance letter or enrollment agreement from the bootcamp.

- A detailed course syllabus outlining the curriculum and learning objectives.

- Tuition invoices and receipts specifying the costs for tuition, fees, books, and other necessary supplies.

- Any documentation demonstrating accreditation or recognition from a reputable educational organization.

- If applicable, documentation separating qualified education expenses from non-qualified expenses (such as career services).

The more comprehensive and detailed the documentation, the stronger the case for reimbursement. It’s advisable to keep all relevant documentation for a minimum of seven years, as that is the standard retention period for tax records.

Potential Limitations and Alternatives

While 529 plans offer a tax-advantaged way to save for education, their applicability to coding bootcamps isn’t always straightforward. Several limitations exist, primarily stemming from the definition of “qualified education expenses” and the accreditation status of the bootcamp itself. Understanding these limitations is crucial for prospective students seeking to leverage 529 funds for this type of training.

Program accreditation significantly impacts 529 plan eligibility. Many states require the bootcamp to be accredited by a nationally recognized accrediting agency, similar to traditional colleges and universities. If the bootcamp lacks this accreditation, using 529 funds might be disallowed, even if the program aligns with the broader definition of “qualified education expenses.” This highlights the importance of verifying both the bootcamp’s accreditation and the specific rules of your state’s 529 plan before relying on these funds.

Accreditation Requirements and 529 Plan Eligibility

The specific accreditation requirements vary by state. Some states may accept accreditation from regional accrediting agencies, while others may have more stringent requirements or may not explicitly address coding bootcamps in their guidelines. It’s essential to check the specific rules of your state’s 529 plan administrator for clarification on accepted accreditation bodies and program requirements. For instance, a bootcamp accredited by the Accrediting Council for Independent Colleges and Schools (ACICS) might be accepted by some states, but not others, depending on the state’s individual rules and regulations concerning 529 plan usage. A lack of clear guidance often necessitates direct contact with the plan administrator to determine eligibility.

Alternative Funding Options for Coding Bootcamps, Can you use 529 for coding bootcamp

If using 529 funds isn’t feasible, several alternative funding options exist. These range from readily available personal savings and income to more specialized financing options designed for vocational training.

Scholarships, Grants, and Loans for Coding Bootcamp Students

Many organizations and bootcamps themselves offer scholarships and grants to reduce the financial burden of tuition. These awards often target specific demographics or focus on particular skills. Additionally, several private lenders offer student loans specifically tailored for coding bootcamps, often with flexible repayment options and interest rates potentially lower than those of general-purpose personal loans. Many bootcamps actively partner with lenders to streamline the loan application process for their students. For example, a student might find a scholarship specifically for women entering the tech field or a loan program with an income-share agreement that ties repayment to future earnings.

Comparison of Funding Methods

Funding a coding bootcamp involves weighing the pros and cons of different methods. 529 plans offer tax advantages but are subject to accreditation limitations. Personal savings offer control but might not cover the full cost. Scholarships and grants provide financial relief but are often competitive and limited in availability. Loans offer flexibility but involve debt and interest payments. The best approach depends on individual financial circumstances, the bootcamp’s cost, and the availability of financial aid opportunities. For example, a student with substantial savings might prioritize personal funds, while a student with limited savings might rely more heavily on loans and scholarships.

State-Specific Regulations and Variations: Can You Use 529 For Coding Bootcamp

Navigating the use of 529 plans for coding bootcamp expenses requires careful consideration of state-specific regulations. While the federal government sets broad guidelines, individual states possess considerable leeway in defining “qualified education expenses” and, consequently, how these plans can be utilized. These variations can significantly impact a student’s ability to leverage 529 funds for this type of training.

State regulations regarding the use of 529 plans for non-traditional educational expenses like coding bootcamps vary widely. Some states have adopted more expansive interpretations of qualified education expenses, encompassing a broader range of programs, while others maintain stricter adherence to traditional definitions. This disparity stems from differing state legislative priorities and interpretations of federal guidelines. The impact on individuals seeking to use 529 funds for coding bootcamps is substantial, with some finding their plans readily applicable and others facing significant limitations.

Examples of State-Specific 529 Plan Regulations

Several states offer illustrative examples of the spectrum of regulations. For instance, some states explicitly include courses at accredited coding bootcamps within their definition of qualified education expenses. These states generally offer more permissive environments for using 529 funds for this purpose. Conversely, other states maintain a stricter interpretation, limiting eligible expenses to traditional degree programs at accredited colleges and universities, effectively excluding coding bootcamps. This disparity highlights the crucial need for individuals to research their specific state’s regulations before relying on 529 funds for bootcamp tuition.

Resources for Locating State-Specific Information

Finding accurate and up-to-date information on your state’s 529 plan regulations is crucial. The following resources can assist in this process:

Can you use 529 for coding bootcamp – The most reliable source of information is the official website of your state’s 529 plan administrator. These websites typically contain detailed brochures, FAQs, and contact information for clarifying any ambiguities. Furthermore, consulting with a qualified financial advisor familiar with 529 plans and state-specific regulations is highly recommended. They can provide personalized guidance based on your specific circumstances and state’s rules.

- Your State’s 529 Plan Website: Each state’s 529 plan program maintains its own website, usually accessible through a web search of “[Your State] 529 Plan”.

- State Treasury or Education Department Websites: These state government websites often contain sections dedicated to education savings plans, including 529 plan information.

- Financial Advisors: A qualified financial advisor can provide personalized advice and guidance on utilizing your 529 plan, taking into account your state’s specific rules.

Tim Redaksi