Scholarships and Grants for Coding Bootcamps: Can You Get Financial Aid For Coding Bootcamp

Securing funding for a coding bootcamp can significantly reduce the financial burden of intensive training. Many organizations recognize the value of upskilling and offer various scholarships and grants to aspiring developers. These funding opportunities can make the difference between pursuing a career change and delaying it indefinitely.

Examples of Organizations Offering Coding Bootcamp Scholarships

Several organizations and institutions offer scholarships specifically designed for coding bootcamp students. These range from large tech companies investing in future talent to smaller, community-focused initiatives. Examples include individual bootcamps themselves offering internal scholarships, Google’s scholarships for underrepresented groups in tech, and non-profit organizations like Code.org that provide grants and support for coding education. Many bootcamps also partner with specific companies offering scholarships to their students. The availability and specific criteria for these scholarships vary widely.

Typical Scholarship Amounts and Award Criteria, Can you get financial aid for coding bootcamp

Scholarship amounts vary considerably, ranging from a few hundred dollars to cover a portion of tuition to full scholarships covering the entire bootcamp cost. Award criteria often include academic merit, demonstrated financial need, belonging to an underrepresented group (e.g., women, minorities, veterans), or a commitment to a specific field of technology. Some scholarships might require an essay or a portfolio showcasing previous work, while others may prioritize students from specific geographic locations.

Strategies for Finding and Applying for Coding Bootcamp Scholarships

Finding and securing a scholarship requires proactive searching and meticulous application. Begin by checking the websites of the bootcamps you are considering; many have their own scholarship programs. Then, explore online scholarship databases, specifically those focused on technology or education. Networking within the tech community and attending industry events can also uncover hidden scholarship opportunities. Carefully read the eligibility requirements for each scholarship and tailor your application to highlight your strengths and align with the criteria. Remember to submit your applications well before the deadlines.

Potential Scholarship Search Resources

A dedicated search strategy significantly improves your chances of finding suitable scholarships. Utilize online resources such as Fastweb, Scholarships.com, and Chegg. Additionally, search directly on the websites of major tech companies, coding bootcamps, and relevant non-profit organizations. Many bootcamps maintain a list of external scholarships on their websites, simplifying your search. Remember to use relevant s when searching online, such as “coding bootcamp scholarships,” “tech scholarships,” or “STEM scholarships.” Exploring state and local government websites may also reveal additional funding opportunities.

Income Share Agreements (ISAs) for Coding Bootcamps

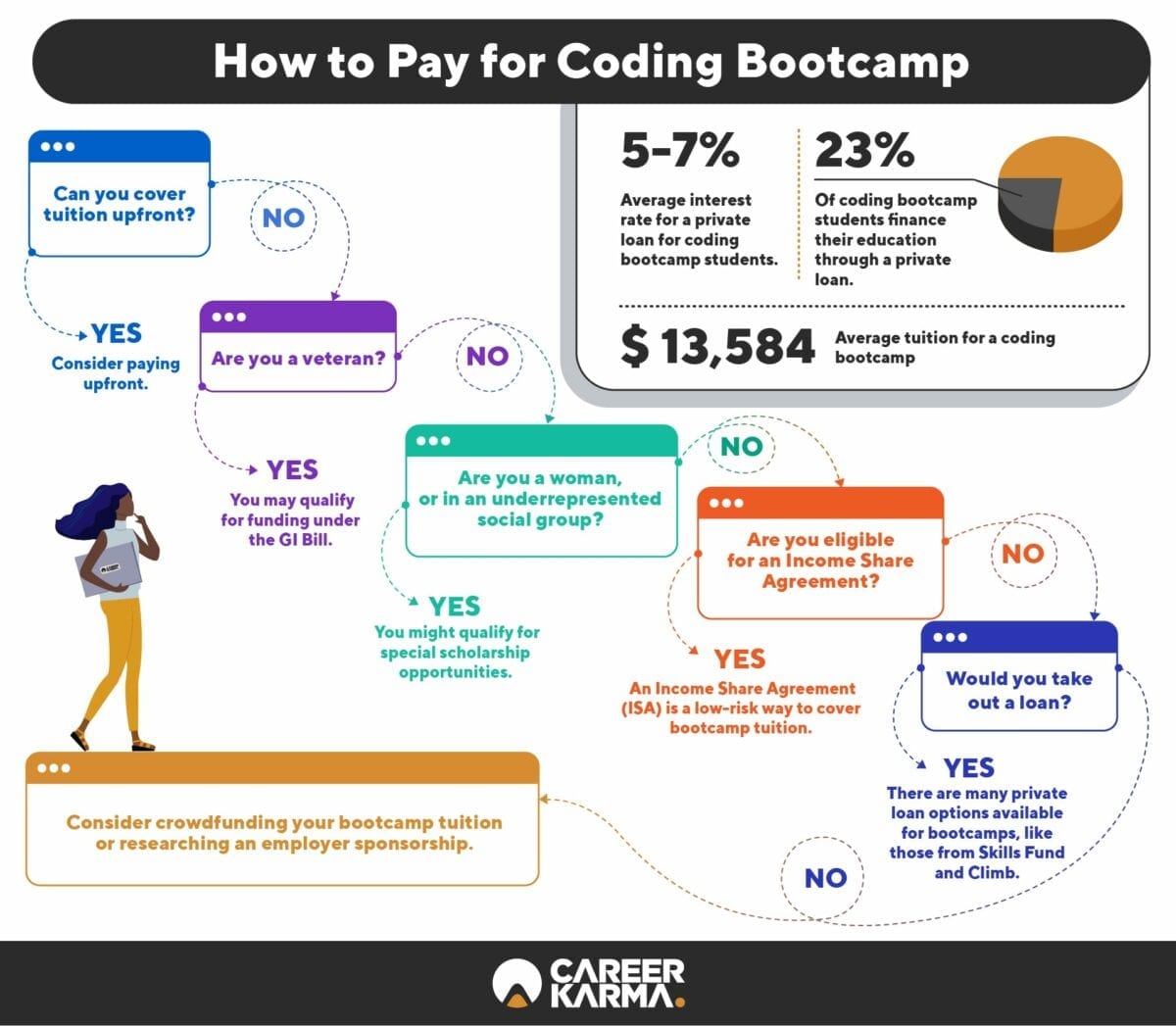

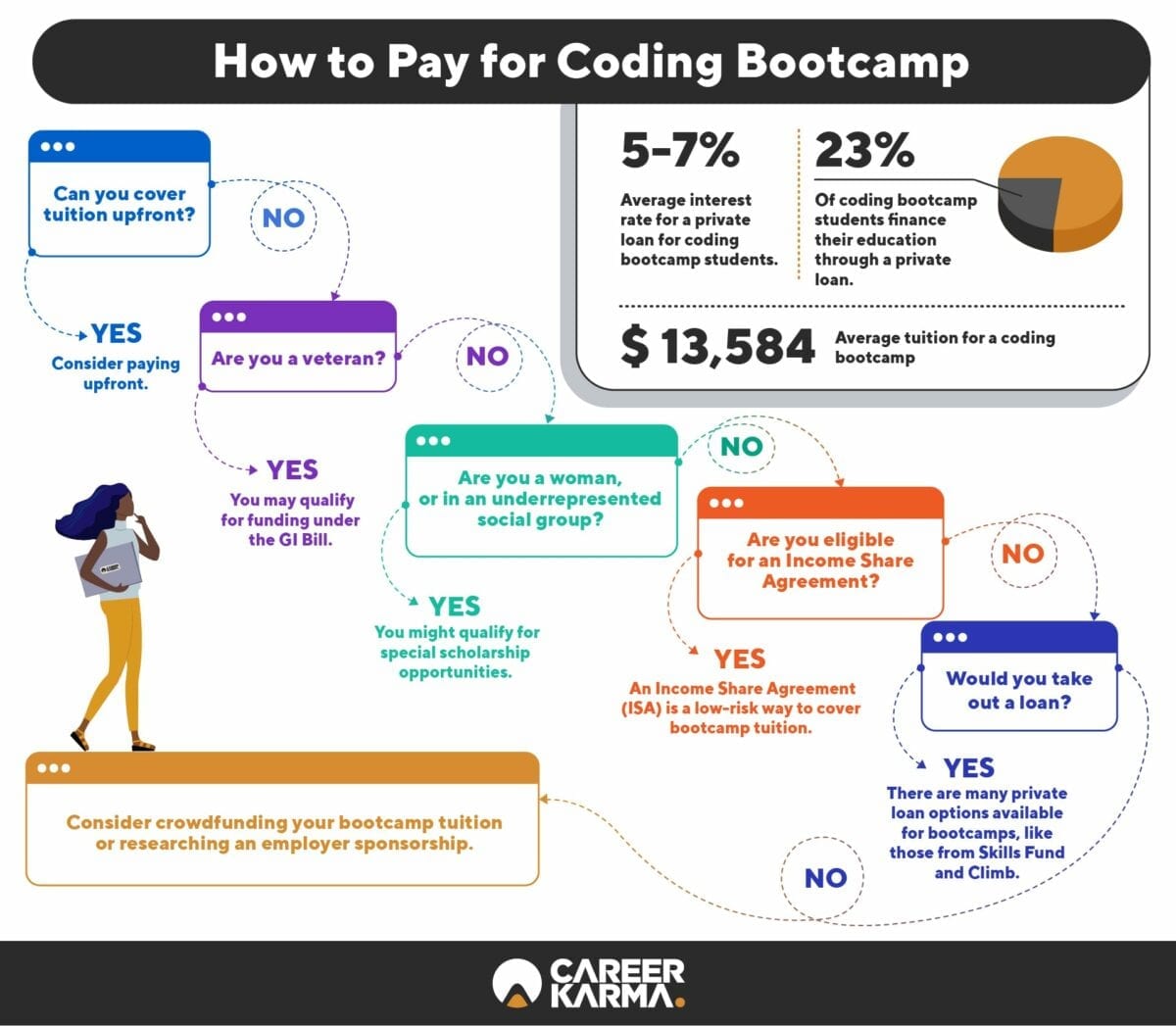

Income Share Agreements (ISAs) are emerging as a compelling alternative to traditional student loans for financing coding bootcamps. Unlike loans, which require upfront payments and accrue interest, ISAs tie your payments to a percentage of your post-graduation income. This means you only pay back a portion of your income for a set period after securing a job in the tech industry that meets the agreement’s criteria. This innovative approach aims to align the bootcamp’s success with the student’s, creating a shared-risk, shared-reward model.

ISAs function by requiring students to commit to paying a predetermined percentage of their income for a specific number of months after graduation, only after they reach a certain income threshold. The percentage and duration vary depending on the bootcamp and the individual’s circumstances. For example, a student might agree to pay 15% of their income for 24 months once they earn above a specific annual salary. The total repayment amount is capped, meaning that even if the student earns significantly more than anticipated, they won’t pay beyond the agreed-upon maximum.

Benefits and Drawbacks of ISAs Compared to Traditional Loans

ISAs offer several advantages over traditional loans. The most significant benefit is the absence of upfront payments and interest accrual during the learning period. This eliminates the immediate financial burden and allows students to focus on their studies. Additionally, the income-based repayment structure ensures that payments are manageable, even if the graduate’s salary is lower than expected. However, ISAs also present drawbacks. The repayment period can be lengthy, potentially extending for several years. Furthermore, if the graduate fails to secure a job within the tech industry that meets the ISA’s criteria, or if their income remains below the agreed-upon threshold, they might not be required to make any payments at all. Conversely, if the graduate secures a high-paying job, the total repayment amount could exceed that of a traditional loan, though the capped nature of the agreement mitigates this risk to a certain extent. Finally, the terms of the ISA, including the income percentage and repayment duration, may be less favorable than traditional loan options for some individuals.

Comparison of ISA Terms and Conditions Across Bootcamps

Different coding bootcamps offer varying ISA terms and conditions. These variations can significantly impact the overall cost and repayment schedule. For instance, some bootcamps may offer lower income share percentages but longer repayment periods, while others might have higher percentages but shorter repayment durations. The income threshold required to trigger repayments also varies, with some bootcamps setting a lower threshold than others. It’s crucial to compare these terms across multiple bootcamps to find the most suitable option. Consider factors such as the total maximum repayment amount, the length of the repayment period, and the income threshold for repayment. For example, Bootcamp A might offer a 15% share for 36 months with a $50,000 income threshold, while Bootcamp B offers 20% for 24 months with a $60,000 threshold. These seemingly small differences can have a significant long-term financial impact.

Questions Prospective Students Should Ask Before Signing an ISA

Before committing to an ISA, prospective students should thoroughly understand the terms and conditions. To ensure a clear understanding, it’s vital to obtain answers to several key questions.

- What percentage of my post-graduation income will I be required to pay, and for how long?

- What is the income threshold that triggers repayments? What happens if I don’t meet this threshold?

- What is the maximum total repayment amount under the ISA?

- What happens if I change jobs or leave the tech industry during the repayment period?

- What is the bootcamp’s job placement rate and average graduate salary?

- Are there any penalties for early repayment or for failing to make payments?

- What are the specific definitions of “income” and “full-time employment” used in the agreement?

- Can I review and understand the complete ISA agreement before signing it?

Planning and Budgeting for Coding Bootcamp

Attending a coding bootcamp is a significant investment, both financially and personally. Success hinges not only on your coding skills but also on your ability to manage your finances effectively throughout the program. Careful planning and budgeting are crucial to ensure you can comfortably complete your bootcamp without accumulating undue stress and debt.

Creating a realistic budget is paramount. Ignoring potential expenses can lead to financial hardship and potentially derail your studies. A comprehensive budget should encompass all anticipated costs, allowing for unexpected expenses and preventing financial surprises.

Budget Components: A Detailed Breakdown

A well-structured budget should include several key components. Tuition fees are the most obvious expense, but equally important are living expenses such as rent, utilities, groceries, and transportation. Additionally, consider the cost of learning materials (textbooks, software subscriptions), potential childcare costs, and any personal expenses you might incur. Factor in additional costs for health insurance, if needed. Finally, allocate a contingency fund for unexpected expenses – a flat tire, a sudden illness, or an unexpected bill can quickly disrupt your finances. Remember to account for any potential loss of income if you’re leaving a job to attend the bootcamp.

Budgeting Tools and Techniques

Several tools and techniques can help simplify the budgeting process. Spreadsheet software like Microsoft Excel or Google Sheets allows you to create a detailed budget, track your spending, and project your income and expenses over the duration of the bootcamp. Budgeting apps, many available for smartphones and computers, offer user-friendly interfaces and automated features to track spending and categorize expenses. The 50/30/20 budgeting rule is a simple yet effective technique: allocate 50% of your after-tax income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. Adapting this rule to your specific circumstances and bootcamp expenses will provide a solid framework.

Developing a Comprehensive Financial Plan

Developing a comprehensive financial plan requires a multi-step approach. First, estimate all your expenses for the bootcamp’s duration. Second, assess your current financial resources, including savings, potential income during the bootcamp (part-time jobs), and any financial aid you’ve secured. Third, identify any funding gaps. This might involve exploring additional funding options like personal loans, family contributions, or refinancing existing debt. Fourth, create a realistic repayment plan for any loans or financial assistance received. This plan should detail the repayment schedule, interest rates, and potential impact on your post-bootcamp finances. Fifth, regularly review and adjust your budget as needed. Unexpected expenses or changes in income may necessitate adjustments to your plan.

Step-by-Step Guide to Financial Planning

- Assess your current financial situation: Determine your income, savings, and existing debts.

- Estimate bootcamp expenses: Calculate tuition fees, living expenses, and other costs.

- Identify funding sources: Explore scholarships, grants, ISAs, loans, and personal savings.

- Create a detailed budget: Use a spreadsheet or budgeting app to track income and expenses.

- Develop a repayment plan: Artikel how you will repay any loans or financial assistance.

- Monitor and adjust your budget: Regularly review your finances and make adjustments as needed.

Tim Redaksi