Funding Options for Coding Bootcamps

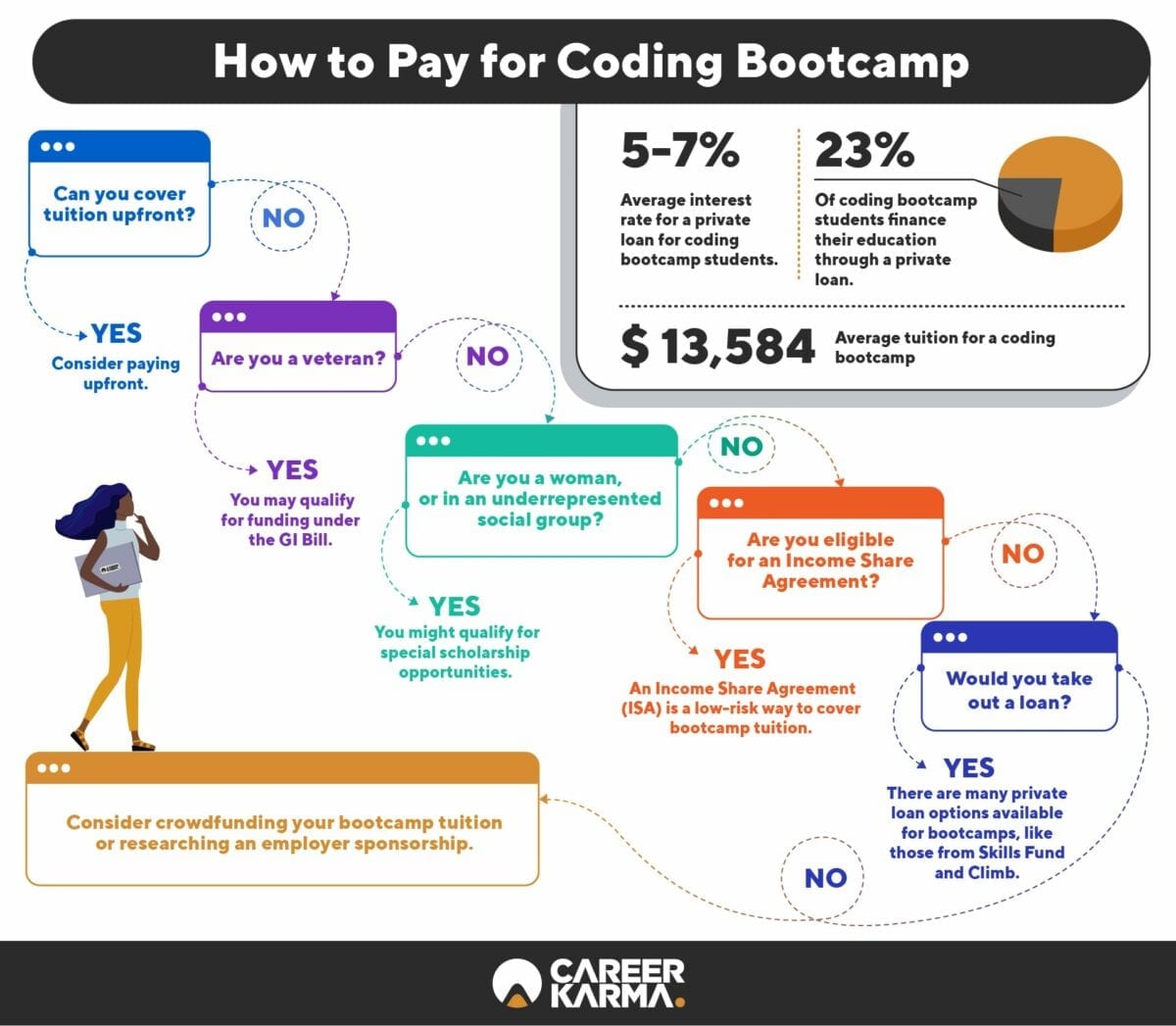

Choosing the right funding method for your coding bootcamp is a crucial step in your journey to a new career. The cost of these intensive programs can be substantial, but several avenues exist to make them financially accessible. Carefully considering your options and understanding the implications of each is key to a successful transition.

Personal Savings

Utilizing personal savings is the most straightforward method. This approach offers complete control over your finances, avoiding interest payments and debt. However, it requires significant upfront savings and may delay your bootcamp enrollment if you need to accumulate sufficient funds. Many individuals save diligently for months or even years before committing to a bootcamp. For example, someone might allocate a portion of their monthly income for a designated savings account specifically for bootcamp tuition.

Loans

Various loan options are available, including personal loans, student loans (if eligible), and bootcamp-specific financing plans. Interest rates and repayment terms vary significantly. Personal loans typically have higher interest rates compared to federal student loans but offer more flexibility in terms of application and usage. Bootcamp-specific financing plans, offered directly by the bootcamp or through partnered lenders, often tailor repayment plans to the student’s post-bootcamp income projections. For instance, a personal loan might have an interest rate of 8-12%, while a federal student loan might range from 4-7%, depending on creditworthiness and loan type. Repayment periods can range from a few months to several years.

Scholarships

Many coding bootcamps and organizations offer scholarships to deserving students based on merit, financial need, or specific demographics. The application process usually involves submitting an application, essays, transcripts, and letters of recommendation. Eligibility criteria vary widely, and successful applicants often demonstrate strong academic records, compelling personal narratives, and a clear commitment to their chosen career path. Some scholarships might cover partial tuition, while others offer full funding. For example, a scholarship might require a minimum GPA, proven community involvement, or focus on underrepresented groups in tech.

Employer Sponsorship

Some employers recognize the value of upskilling their workforce and offer tuition assistance or sponsorship programs for employees seeking to enhance their technical skills. This often involves presenting a well-defined proposal outlining the bootcamp’s curriculum, its relevance to the employee’s current role or future contributions to the company, and a plan for applying newly acquired skills. Securing employer sponsorship may involve discussions with your manager or HR department, presenting a compelling case for your professional development, and potentially negotiating the terms of the sponsorship agreement. This option requires proactive communication and a demonstration of value to the employer.

Funding Options Comparison

| Funding Option | Pros | Cons | Application Requirements |

|---|---|---|---|

| Personal Savings | No interest, complete control | Requires significant savings, may delay enrollment | Sufficient savings |

| Loans (Personal/Student/Bootcamp-Specific) | Accessibility, flexible repayment options | Interest accrual, debt burden | Credit check, income verification, application form |

| Scholarships | Reduced or eliminated tuition costs | Competitive application process, limited availability | Application form, essays, transcripts, recommendations |

| Employer Sponsorship | Tuition covered by employer | Requires employer buy-in, may have stipulations | Proposal outlining bootcamp relevance, negotiation with employer |

Budgeting and Financial Planning for Bootcamp: How To Pay For Coding Bootcamp Reddit

Successfully navigating the financial aspects of a coding bootcamp is crucial for a positive learning experience and a smooth transition into a new career. Careful budgeting and financial planning will minimize stress and maximize your chances of success. This section will guide you through creating a realistic budget and managing your finances effectively throughout your bootcamp journey.

Total Bootcamp Cost Calculation

Calculating the total cost involves more than just the tuition fee. You need a comprehensive overview encompassing all associated expenses. This includes tuition, living expenses (rent, utilities, groceries), transportation costs, books and materials, and any personal expenses. For example, a bootcamp with $15,000 tuition, $10,000 for rent and utilities over the bootcamp duration, $3,000 for groceries and transportation, and $2,000 for books and other miscellaneous expenses would result in a total cost of $30,000. It’s vital to be realistic and potentially overestimate expenses to account for unforeseen costs.

Creating a Realistic Monthly Budget

A detailed monthly budget is essential for managing your finances during the bootcamp. This involves tracking all income sources (e.g., savings, loans, part-time work) and meticulously listing all expenses. Here’s a step-by-step guide:

- List all income sources: Include salaries, savings withdrawals, loan disbursements, and any other regular income streams.

- Categorize expenses: Create categories like rent/mortgage, utilities, groceries, transportation, tuition payments, personal care, entertainment, and debt payments.

- Track spending: Use budgeting apps or spreadsheets to monitor your spending habits and identify areas where you can cut back.

- Allocate funds: Assign a specific amount to each expense category, ensuring that your total expenses don’t exceed your income.

- Regularly review and adjust: Your budget isn’t static. Review it weekly or monthly to ensure it aligns with your actual spending and adjust as needed.

Financial Management and Debt Avoidance

Effective financial management is key to avoiding excessive debt. Consider these strategies:

- Explore funding options: Exhaust all available funding options before resorting to high-interest loans. This includes scholarships, grants, and income share agreements.

- Prioritize essential expenses: Focus on necessities like rent, food, and tuition. Cut back on non-essential spending to free up funds.

- Build an emergency fund: Having a small emergency fund can prevent unexpected expenses from derailing your budget.

- Seek financial advice: If you’re struggling to manage your finances, consider seeking advice from a financial advisor.

Sample Budget Spreadsheet

This sample budget illustrates a potential financial plan. Remember to adapt it to your specific circumstances.

| Category | Income | Expenses | Savings |

|---|---|---|---|

| Monthly Salary/Savings | $3000 | ||

| Tuition | $1250 | ||

| Rent/Mortgage | $800 | ||

| Utilities | $200 | ||

| Groceries | $300 | ||

| Transportation | $150 | ||

| Personal Care | $100 | ||

| Entertainment | $100 | ||

| Total | $3000 | $2900 | $100 |

Alternatives to Traditional Bootcamps

Choosing a coding bootcamp is a significant financial and time commitment. Fortunately, several viable alternatives exist, offering different learning pathways and cost structures. Understanding these options allows you to make an informed decision that best aligns with your budget, learning style, and career goals.

How to pay for coding bootcamp reddit – This section explores alternative methods for acquiring coding skills, comparing their costs, benefits, and drawbacks against traditional bootcamps. We will also examine the possibility of self-funding your education through freelance work.

Online Courses and Self-Paced Learning

Online learning platforms offer a vast array of coding courses, catering to various skill levels and programming languages. These platforms often provide structured curricula, video lectures, coding exercises, and community forums for support. Popular options include Coursera, edX, Udacity, and Codecademy. The cost is generally significantly lower than bootcamps, ranging from free (for basic courses) to several hundred dollars for comprehensive programs. Self-paced learning allows flexibility, but requires strong self-discipline and motivation. The lack of direct instructor interaction and peer support can also be a drawback for some learners. Successful self-learners often demonstrate exceptional initiative and resourcefulness in supplementing their learning with additional resources.

Coding Apprenticeships

Coding apprenticeships offer a unique blend of structured learning and practical experience. Participants work alongside experienced developers, learning through hands-on projects and mentorship. While many apprenticeships are unpaid or offer a modest stipend, they provide invaluable real-world experience and build a strong professional network. The competitive nature of securing an apprenticeship, however, necessitates a demonstrable aptitude for coding, often requiring a portfolio of prior projects or a strong foundation in programming fundamentals. This option is best suited for individuals with some prior coding experience and a strong commitment to the profession.

Self-Funding Through Freelance Work

Many aspiring developers supplement their learning by undertaking freelance projects. This approach allows for hands-on experience, income generation, and building a portfolio simultaneously. Platforms like Upwork and Fiverr provide access to freelance opportunities. However, this path requires a proactive approach to marketing oneself, managing client expectations, and balancing work with learning. Starting with smaller, simpler projects is crucial to build confidence and a positive client reputation. Successful self-funding requires strong time management skills and the ability to handle the pressures of client deadlines.

Comparison of Learning Methods, How to pay for coding bootcamp reddit

The following table compares the cost, time commitment, and other key aspects of bootcamps, online courses, and self-learning.

| Feature | Bootcamp | Online Courses | Self-Learning |

|---|---|---|---|

| Cost | $10,000 – $20,000+ | $0 – $1,000+ | Variable (books, software, etc.) |

| Duration | 3-6 months (intensive) | Variable (weeks to years) | Variable (months to years) |

| Structure | Highly structured curriculum | Structured or unstructured | Highly unstructured |

| Instructor Interaction | High | Variable | Low to none |

| Career Support | Often included | Rarely included | Requires self-initiative |

Tim Redaksi